Nanotechnology

The term nanotechnology might seem like something reserved for a science lab, but it is as close as the latest pregnancy announcement that you may have heard.

That’s right, the second pink line on a pregnancy test only appears if the hCG hormone is present. If the tester is pregnant, gold nanoparticles tagged with a specific antibody attach to the hCG on the second strip.

And nanotechnology is doing more than telling women they are pregnant. Advances are improving bulletproof vests, making plastic beer bottles possible, and coating products to make them better— from flame resistant furniture to fortified glass surfaces to antimicrobial bandages.

The global nanotechnology market is projected to reach $2.23 billon by 2025 according to a study by Allied Market Research. This growth is credited to increasing applications across industries, including communication, medicine, transportation, agriculture, energy, materials and manufacturing, and consumer products.

What is Nanotechnology?

A nanometer is the microscopic measurement of one billionth of a meter. For perspective, consider that one sheet of paper is roughly 100,000 nanometers thick.

According to the National Nanotechnology Initiative, nanotechnology is, “the study and application of extremely small things and can be used across all the other science fields, such as chemistry, biology, physics, materials science, and engineering.” In other words, it’s the ability to manipulate and create matter, enhancing it for the purpose it will serve, at the molecular level.

Why Invest in Nanotechnology?

Nanotechnology is an exciting investment opportunity because of its growing, impactful applications across industries.

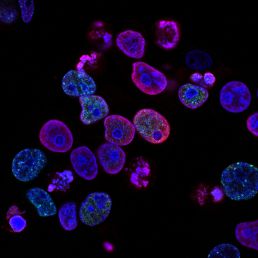

Nanotech innovation and their applications have a range of biomedical potential. In medicine, specifically, nanotechnology is solving real-world health challenges by innovating from prevention to diagnostics to treatment.

For example, antibiotics have long been a standard treatment for infection. However, the overuse of antibiotics has resulted in increasingly drug-resistant bacteria. According to the Centers for Disease Control and Prevention (CDC), there were an estimated 119,247 cases of drug-resistant Staphylococcus aureus bloodstream infections and 19,832 associated deaths nationwide in 2017.

As an alternative to antibiotics, novel nanomaterials can combat pathogens, not only offering a more targeted delivery of medicine and therapeutics, but also a more targeted treatment.

The potential for nano-driven solutions to public health issues is not lost on big investors.

Novo Holdings REPAIR Impact Fund, recently invested EUR 7 million in Mutabilis, a company developing novel antibacterials for drug-resistant bacteria.

And nanovaccines against both bacteria and cancerous tumors are also in the works, according to a recent report from the Advanced Materials “Biomimetic Nanotechnology toward Personalized Vaccines.” Not only can nanotechnology “increase the potency of vaccines,” it can personalize applications of both vaccines and treatments with the potential for tremendous social and economic impact.

Nanotechnology is also helping patients suffering from endometriosis, a condition that affects 10% of childbearing-age women.

The traditional treatment for the condition was to surgically remove lesions, which often recur after surgery and require multiple invasive surgeries. Using nanotechnology, scientists instead employ tiny polymeric materials packed with a specialized dye. The tiny materials fluoresce to show where the lesions are (essentially providing imaging) and then kill the lesion cells by flaring to 115 degrees Fahrenheit upon exposure to near-infrared light, helping to remove the lesions.

Nanotechnology is also improving cardiovascular care by reducing the size and improving the effectiveness of instruments used for cardiac surgery.

There’s even the potential for nanorobots to operate within the human body, analyzing and reporting on specific tissues.

Nanotech also has broad potential beyond the healthcare field.

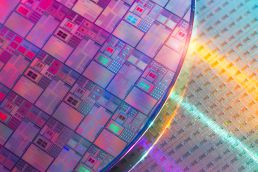

Nanotechnology is constantly improving electronics, which, as they become smaller and smaller, also become increasingly harder to manufacture. Nanotech can shrink these technology tools so that they fit in our pockets while also making them better at processing data, increasing memory space, making wearable tech lighter and more portable, and improving functionality overall.

Nanotechnology is also responsible for the lithium-ion battery. Offering a minimum power draw and high-energy-density, these now commonplace batteries weren’t on the market until the 1990s. Since then, they’ve become increasingly more powerful and less expensive.

And yet, the innovation hasn’t stopped. The world is now taking stock of graphene, a single, thin layer of graphite. Although graphene shares the same atoms as graphite, its properties are extremely different because the atoms are arranged differently.

Nanotech Energy, a battery and graphene technology startup, recently secured $27.5 million in funding, according to the company. Founded in 2014, the company plans to release a non-flammable, environmentally friendly lithium battery that charges much quicker than those currently on the market in the coming year.

How to Invest in Nanotechnology

The growth potential for nanotechnology is impressive, but the sector doesn’t come without risk. Although nanotech has been around for years, it is still considered an emerging field and the industry is still sorting out where the best, most profitable applications lie. This can make investing in individual nanotechnology companies a risky proposition.

However, a search on Magnifi indicates that there are a number of ETFs and mutual funds available to give investors broad exposure to this industry without concentrating their bets on any one company.

Unlock a World of Investing with a Magnifi Account

Magnifi is changing the way we shop for investments, with the world’s first semantic search engine for finance that helps users discover, compare and buy investment products such as ETFs, mutual funds and stocks. Open a Magnifi investment account today.

The information and data are as of the June 8, 2021 (publish date) unless otherwise noted and subject to change. This blog is sponsored by Magnifi.

Drones

Unlock a World of Investing with a Magnifi Account

Pick a beach, park or other open area, and you might get the impression that flying drones seem to have replaced flying kites. While this is partly true, the depth and breadth of the applications of drone technology go far beyond recreation to an advancing and growing market of military and commercial uses.

From agriculture and environmental monitoring, to law enforcement and delivery services, drones are improving and expanding the efficiency and accuracy of research and commercial projects around the world in a myriad of ways.

More and more, companies are realizing this and investing in new drone technologies. According to the Federal Aviation Administration’s 2019 Aerospace Forecast, the FAA expects the commercial drone market to triple by 2023. According to a market report published in September 2020, the global Commercial Drone market size is projected to reach $34 billion by 2026, a considerable jump from the $6 billion it racked up in 2020.

Here’s what investors should know about drone technology and their market potential.

What Are Drones?

Drones, the more common name for Unmanned Aerial Vehicles (UAVs), are unpiloted aircraft or spacecraft. They vary in shape, size, and use. For example, some drones require a human operator, but some do not. Some drones are so small they can fit in your hand, while some are as large as traditional aircraft.

There are three standard types of drones, including Single Rotor Helicopters, Multi-Rotor Drones, and Fixed Wing Drones. Single Rotor Helicopters look like small helicopters, and they are often used to transport heavy objects, survey land, and gather data. Multi-Rotor Drones are small and often used for photography or hobby-flying. Fixed-wing drones look like normal airplanes and run on fuel rather than electricity, allowing them to run for much longer.

While drone applicability is expanding in the modern world in tandem with advancing drone technology, the notion of utilizing unpiloted aircraft isn’t a new one. Drones were first used in the mid-1800s when in 1849, Austria launched a balloon bomb attack on Venice. By WWII, technology had advanced to models like Austrian Jindivik, a pilotless target aircraft.

It’s not surprising that drone technology has been advanced by militaries around the world for many years. This is in part because drones offer a range of military uses, from reconnaissance that doesn’t necessitate putting a pilot’s life at risk to offensive strikes in hard-to-reach areas. Drones also don’t require rest like their human counterparts, just enough fuel or battery power to fulfill their mission.

Drones are also playing an important role in advancing our knowledge of space. NASA’s Dragonfly mission will use a drone to sample and examine sites around Saturn’s icy moon beginning in 2026. This will be the second outer space drone mission, following the launch of a small helicopter scout as part of NASA’s Mars 2020 rover mission, expected to land in February 2021.These advanced outer space missions are not to mention that in 2019, X-37B an astronaut-free spacecraft that has clocked as many as 719 days in continuous low-earth orbit. X-37B is a reusable spacecraft that has taken five missions since 2010.

Somewhat surprisingly, it wasn’t until 2006 that non-military, commercial applications of drones began. Then, suddenly, their uses expanded to functions from pipeline inspections to crop evaluation to security and beyond.

Why Invest in Drones?

In the modern world, the application of drones is exploding. And, it’s playing a role in not only the advancement of science and industry, but also real-world geopolitics.

In the ongoing conflict between Azerbaijan and Armenia over the region of Nagorno-Karabakh, for example, drones are a contentious weapon. In early October 2020, Canada boldly “suspended the sale of advanced drone optics to Turkey over allegations that the technology is being used in the conflict” to support Azerbaijan. At the end of October 2020, Armenia called for more Western nations to do the same.

In Malaysia, the state of Selangor is planning drones to patrol waterways for polluters day and night, a prevalent issue that plagues the country.

In China, the use of agricultural drones has seen a dramatic uptick, improving farming efficiency. Chinese agricultural drones can cover more than 50 to 60 times the amount of farmland that more traditional manual farm work can.

In the U.S. poultry industry, drones and robots are expected to play an increasing role in more efficient production. For example, drones can be used to spot dead birds, or even monitor the gait of birds to detect illness. Likewise, drones have the potential to administer aerosol vaccines. These applications are particularly promising considering that producers can purchase quality drones starting at only $500.

And let’s not forget about the drone delivery of online purchases we’ve all been waiting for.

In September 2020, Amazon.com Inc. received approval from the Federal Aviation Administration to “establish a fleet of drones” and begin testing drone deliveries. It follows companies including Uber Technologies Inc., Wing (of Google’s parent company Alphabet), and UPS. This is a long-awaited step forward after Amazon’s first announcement that it would pursue drones for delivery in 2013.

Behind all these advances (and many more) there are numerous companies developing, manufacturing, and selling this in-demand technology. So, while the hobby-drones that we see at the park are indeed a multi-billion-dollar industry, they are the tip of an iceberg of opportunity for investors with an eye towards the future.

How to Invest in Drones

From military and defense applications, to surveying and data collection, drones are everywhere these days. That can make it challenging for investors who want to get into the space; there are just so many options out there to consider.

However, there are a number of mutual funds and ETFs that give investors access to the drone industry without having to focus on any particular companies. A search on Magnifi suggests that investors have a number of choices in this fast-growing industry.

Unlock a World of Investing

with a Magnifi Account

Magnifi is changing the way we shop for investments, with the world’s first semantic search engine for finance that helps users discover, compare and buy investment products such as ETFs, mutual funds and stocks. Open a Magnifi investment account today.

The information and data are as of the November 11, 2020 (publish date) unless otherwise noted and subject to change. This blog is sponsored by Magnifi.

Data Infrastructure

We shop online, we send emails, we subscribe to newsletters, we stream television shows, we listen to podcasts, we Instagram, we tweet, we share on Facebook, we Google, and in doing so, we create data. We create tons of data.

In fact, 1.7MB of data is created by every person on earth every second of the day. In the last two years alone, 90% of the world’s data has been created according to the Information Overload Research Group (IORG).

Where is all of this data coming from?

Every day, 306.4 billion emails are sent, and 5 million thoughts are Tweeted. One scroll through our inbox might make us feel like the extent of data overload isn’t that unbelievable, after all.

The fact is that we do a lot of online sharing. Companies that want consumer dollars know this, and they aren’t standing idly by. Beyond the giants of the tech industry like Google and Amazon, small- and medium-sized enterprises increasingly want effective data analytics tools to maximize revenue, according to Advance Market Analytics.

Interestingly, according to Forbes, jobs including Data Scientists and Big Data Engineers are in demand now more than ever before. These companies are investing in better data infrastructure to get better data.

All of that data, and all of those needs, make the data infrastructure ecosystem increasingly complex. Here’s what investors should know about this growing industry that’s not expected to slow down anytime soon.

What Is Data Infrastructure?

Before diving into data infrastructure, let’s discuss big data—or, the information that companies everywhere are trying to generate insights from. Big data has four “Vs” or measures of value: volume-based, velocity-based, variety-based, and veracity-based.

Volume-based value means that “the more comprehensive your integrated view of the customer and the more historical data you have on them, the more insight you can extract.”

Velocity-based value means that the faster that “you can process information into your data and analytics platform, the more flexibility you get to find answers to your questions via queries, reports, dashboards, etc.”

Variety-based value means that “the more varied customer data you have – from the CRM system, social media, call-center logs, etc. – the more multifaceted view you develop about your customers.”

Veracity-based value refers to the accuracy and cleanliness of customer data.

Why do these Vs matter, again? They are the end goal of good data infrastructure, which is the way that data is used to provide useful insights. It means having the “right tools for storing, processing and analyzing data.

Let’s start with storage. It seems like almost everything is stored on the cloud these days, but where exactly is that?

The cloud is typically an off-premises data center that is accessed remotely through the internet. Cloud data centers allow clients to manage their data through third-party managed services, using hardware that’s run and serviced offsite by cloud companies in physical locations around the world. In essence, these companies are creating a virtual infrastructure for the systems that used to be housed on-site in every corporation.

With the overwhelming growth in data creation, physical data centers that service these cloud companies are multiplying, and so is investment in them.

Storage, of course, is only one component of data infrastructure. Beyond storage, data infrastructure includes the network that transfers the data, the applications that host the analytics tools and “the backup or archive infrastructure that backs it up after analysis is complete.”

Why Invest in Data Infrastructure?

According to a report by the Motley Fool, “data is the oil of the digital economy.”

Effective data infrastructure means more money and more efficiency, and not just for retailers figuring out how to get an online shopper back to their site to add something to a shopping cart.

Bankers, for example, can use big data to help minimize risk and fraud. Moreover, manufacturers can use it to quickly troubleshoot problems, making better business decisions.

For all sorts of businesses, benefits of using data strategically or prioritizing good data infrastructure include reduced costs, reduced time spent, optimization of product development and allocation, and more informed decision making.

According to an Advance Market Analytics report, the demand for big data as a service is driven by (1) an increasing demand for real time data analytics solutions, (2) the growing use of big data to identify fraud, and (3) a significant data influx for small and medium sized enterprises that want effective data analytics tools to maximize revenue. These are aided by market trends including the (1) the rise of cloud computing and the integration of big data with cloud-based services, (2) a huge influx of data, and (3) more modern business models.

The power of big data is a frontier of sorts. And, beyond the companies looking to improve their own businesses by employing data services, there are a multitude of innovative companies streamlining huge amounts of data into useful information.

For investors, this means that there is more than one way to invest in this growing industry. Fortunately, there are a number of ETFs and mutual funds available for investors interested in supporting big data and the growth of data infrastructure. For instance, a search on Magnifi suggests a number of different options.

Unlock a World of Investing with a Magnifi Account

Magnifi is changing the way we shop for investments, with the world’s first semantic search engine for finance that helps users discover, compare and buy investment products such as ETFs, mutual funds and stocks. Open a Magnifi investment account today.

The information and data are as of the October 1, 2020 (publish date) unless otherwise noted and subject to change. This blog is sponsored by Magnifi.

Adtech

Advertising in 2020 is way more than a billboard on the side of a highway these days. When it comes to catching consumer eyeballs, it’s personal.

As consumers, we know it well. We can’t scroll to a news site, or any site for that matter, without a barrage of ads that may or may not be tailored to our interests. And it’s true— thanks to advertising technology, advertisements are more targeted than ever.

Adtech is a relatively new industry that has become part of the fabric of the modern world, and it’s only just begun.

For consumers these days, the constant ads are the price of free, and so mostly, we accept it. After all, we aren’t paying for Google search, for Facebook, or to watch our favorite show on YouTube.

The internet-based services that have become so ingrained in our daily lives learn about us so that they can most successfully serve us ads and use those dollars to provide their services. This is especially true since the coronavirus pandemic shifted so many “in-person” norms to virtual experiences.

It’s a crazy world we live in, and for all of the unknowns, we can rest assured that advertising isn’t going away anytime soon.

What Is Adtech?

Advertising technology (or adtech) is driven by what’s called programmatic advertising. If that sounds more like an AI algorithm than a sales team, that’s because it is.

Programmatic advertising is “the real-time buying and selling of ad inventory through an automated bidding system. Programmatic advertising enables brands or agencies to purchase ad impressions on publisher sites or apps through a sophisticated ecosystem.”

And while we all gasp at how expensive Super Bowl commercials are every year, we don’t always consider how companies try to get in front of their target audience 365 days per year while consumers watch, click, and scroll throughout the day.

Programmatic advertising includes display ads, video ads, social ads, audio ads, native ads, and digital out-of-home ads. It’s at play whether we Google something random or tune into the season finale of our favorite show.

Consumer ad fatigue has simply led to more creative ways to grab interest. For example, native ads appear to be part of the media they appear on, rather than stand out like a pop-up or a banner ad.

The Economist famously used programmatic advertising to tap into an entirely new audience. In one campaign, it generated 650,000 new prospects with a return on investment (ROI) of 10:1 and increased awareness by almost 65%.

How did it achieve such success? It referenced subscriber, cookie, and content data to identify audience segments (finance, politics, economics, good deeds, careers, technology, and social justice), creating more than 60 ad versions to target potential customers effectively.

No longer was The Economist considered a dry, intellectual journal by most. Instead, it had new relevance. What’s more, it had new readers.

Adtech isn’t limited to the internet. For example, how many people have you heard at least consider ditching cable and just using streaming services? Meet connected TV, which is anticipated to grow to reach 204.1 million users by 2022 according to eMarketer.

As subscribers to services including Netflix, Hulu, Amazon Prime, and Disney Plus have increased, so have over-the-top (OTT) advertising dollars to the tune of $5 billion in 2020. These ads are typically highly personalized according to a viewer’s interest and cannot be skipped, but rather must be viewed to continue consuming content.

Ads on our computers aren’t the only adtech at play. Digital out-of-home advertising includes the high-tech billboards, on-vehicle ads, etc. Where online advertising can feel nagging, outdoor advertising is innovating in a way that appears interesting and grabs attention. According to IBIS World, in 2019 billboard advertising revenue grew by more than $8.6 billion in advertising revenue.

Why Invest in Advertising Technology?

Lots of companies these days don’t necessarily run on our dollars, they run on our eyeballs, and our clicks. According to VentureBeat.com, “all major ad-supported tech companies are ad tech companies. They market advertising technology and use technology to support their advertising businesses.” This includes Facebook, Google, Pinterest, and Reddit.

Adtech is the way of the future, especially as technology evolves and consumers become increasingly glued to screens. In addition to enhanced targeting capabilities, programmatic advertising gives companies real-time insights, enhanced targeting capabilities, greater transparency, and better budget utilization.

Advertising is part of the fabric of our modern culture. Because companies can use platforms to serve us advertisements, we have access to tons of information and entertainment for no cost. As a consumer, it’s hard to ignore.

It’s not just Google searches and websites that are ideal for digital ads. “In-game brand advertising is set to see tremendous growth in the coming years,” says Ajitpal Pannu, CEO of Smaato, an adtech platform. “We are building up a strong foundation to support this new media channel.”

COVID, interestingly, has moved more eyeballs on screens than ever before. And while advertising spending is down across the board as companies move to save money, adtech spending is bound to rebound, making now an ideal time to invest.

How to Invest in Adtech?

Advertising is by nature a very broad industry. Just about every company advertises in some way, and the technologies driving those activities are all over the map. Fortunately, a search on Magnifi suggests that there are a number of ETFs and mutual funds to help interested investors access the growing adtech sector without having to invest in many different companies.

Unlock a World of Investing with a Magnifi Account

Magnifi is changing the way we shop for investments, with the world’s first semantic search engine for finance that helps users discover, compare and buy investment products such as ETFs, mutual funds and stocks. Open a Magnifi investment account today.

The information and data are as of the September 14, 2020 (publish date) unless otherwise noted and subject to change. This blog is sponsored by Magnifi.

Electric Vehicles

Unlock a World of Investing with a Magnifi Account

What was once (not too long ago) a niche sideshow in the automotive market is poised to take over the whole thing, with electric vehicles anticipated to dominate car sales by 2040, according to BloombergNEF’s Electric Vehicle Outlook 2020.

But is the mass adoption of electric vehicles really as far off as 2030, when some projections anticipate that battery-powered cars will start to outsell conventional combustion engines? Or, is the electric vehicle revolution already here?

Right now, the prices of electric vehicle stocks are jumping. Tesla, which is expected to announce new battery technology in September, jumped 13% in one morning in June to an all time high of $1,746.69. Now, it’s as high as $1,835.64 and looking at the next milestone of $1,900.

Workhorse, a maker of electric vans, also jumped after it cleared the next hurdle to participation in California’s zero-emission subsidy program. These, in addition to a jump for the Chinese electric vehicle maker NIO, the Chinese electric scooter maker Niu, show the enthusiasm for the EV market.

And there should be. Here’s why.

What Are Electric Vehicles?

All-electric vehicles (EVs) are cars and trucks equipped with an electric motor rather than a traditional internal combustion engine. The electric motor is powered by a large traction battery pack which requires a charging station or wall outlet to charge.

Because EVs are powered by electricity, they don’t have the tailpipe that emits exhaust as is typical of internal combustion engines. EVs also do not require liquid fuel components, including a fuel pump, fuel line, or fuel tank. Hybrid vehicles, however, still do have these components, as they typically switch over to an internal combustion engine when the electric battery becomes depleted.

Why Invest in Electric Vehicles?

Simply put, electricity is the future of transportation.

EVs have the potential to help slash carbon emissions and lower costs for drivers, which is why public utilities such as Xcel Energy are pushing to get 1.5 million electric cars on the road by 2030.

When investing in EVs, it’s more than a matter of purchasing pricey Tesla stock or not. Lots of companies stand to benefit from the adoption of electric vehicles, from battery manufacturers to companies thinking creatively about how to charge electric vehicles.

These companies are trying to solve the biggest challenges for electric vehicles that have been stumbling blocks to their mass adoption. Namely, the production of batteries that hold a greater charging capacity for a longer period and the accessibility of charging opportunities.

For example, a new type of battery—solid-state electrolyte— is scheduled to enter the commercial market in 2023. Solid-state batteries are generating major excitement for electric vehicle makers. The solid version of the battery can hold three times more energy than its traditionally liquid counterpart, not to mention it can hold that energy more efficiently and ultimately last longer. Battery prices are expected to fall as their energy density improves, making electric vehicles increasingly more affordable.

EVs continue to become more mainstream as they become more affordable and charging equipment becomes more widely available. Blink Charging, for example, designs, manufactures, and operates an electronic vehicle charging network that is managed by cloud software. According to the company, its EV charging equipment sales increased by more than 350% and its revenues for just the first six months of 2020 surpassed its total revenues for all of 2019.

But, there’s more to all-electric vehicles than batteries and charging stations.

Specifically, the list of key components in electric cars is long. In addition to the usual wheels and tires, you also need:

- A charging port

- A DC/DC converter

- An electric traction motor to drives the wheels

- An onboard charger that accepts energy from the charge port and converts it to charge the battery

- A power electronics controller to “manage the flow of electrical energy delivered by the traction battery”

- A thermal system to maintain an appropriate temperature range

- A traction battery pack to store electricity for the motor

- An electric transmission

- And more…

In other words, a shift from conventional combustion engines to all-electric means a shift to makers of these parts for suppliers.

For example, Aptiv develops safety systems for electric vehicles. Safety systems are crucial considering the high voltage that powers electric vehicles and the “more than 8,000 connection points in a typical electric vehicle.”

Delphi offers automakers powertrain, electrical and battery management solutions for components including inverters, high-power electrical centers, high-voltage connection systems, combined inverter DC/DC converters (CIDD), high-voltage shielded cables, on-board and plug-in chargers and charging inlets.

Magna offers complete vehicle manufacturing, producing vehicles for BMW, Daimler, Jaguar Land Rover and Toyota. Magna was selected by the Beijing Automotive Group Co., Ltd. (“BAIC Group”) in 2019 to “produce up to 180,000 electric vehicles per year in China…starting in late 2020.”

Amphenol develops and supplies advanced interconnect systems, sensors, and antennas for hybrid and electric vehicles.

These and other companies are poised for growth and are ripe for investment.

How to Invest in Electric Vehicles

Electric vehicles will outnumber traditional fuel-powered cars before we know it. Now is the time to get ahead of the curve, before affordable, little known stocks rise to the heights of Tesla. A search on Magnifi indicates that there are a number of ways for investors to access this fast-growing segment via ETFs and mutual funds, rather than focusing only on individual companies.

Unlock a World of Investing with a Magnifi Account

Magnifi is changing the way we shop for investments, with the world’s first semantic search engine for finance that helps users discover, compare and buy investment products such as ETFs, mutual funds and stocks. Open a Magnifi investment account today.

The information and data are as of the August 25, 2020 (publish date) unless otherwise noted and subject to change. This blog is sponsored by Magnifi.

Cloud Computing (SaaS)

Unlock a World of Investing with a Magnifi Account

Software-as-a-Service is now standard, from mobile phones and laptops to business solutions for the largest of entities. It seems that there’s an app for everything, and it’s all personalized to each user’s credentials.

Is your gym closed during Covid-19? Subscribe to Truecoach to build an online training platform for customers. Need to set up an online store, especially with COVID-19 closures? Build one on Shopify. Too busy to make a baby book? Text Queepsake your baby milestones and they’ll make one for you. (Not kidding.)

The solutions are big, small, and endless.

But, it wasn’t always that way.

Cloud computing has transformed how users interact with software. Before the software-as-a-service model, users had to purchase their software, either on physical media or via direct download, and had to pay for updates or replacements as technology improved. These days, that’s not how it works.

Rather than purchase software annually or biannually, users pay for access to the software that they need on a subscription basis. They have credentials and they pay a small fee to accomplish their needs.

This model has transformed how we operate as a society, and it offers a frontier of investment opportunities as software companies strive to create solutions for the next big thing.

What Is SaaS?

Salesforce, which pioneered the software-as-a-service model in 1998 defines software-as-a-service as “a way of delivering centrally hosted applications over the internet as a service. SaaS applications are sometimes known by other names: Web-based software, On-demand software, and Hosted software”

How is this different from previous models?

Consider that hardware is the physical computer or user device. Now consider that software is the programs and apps that help users do things on the computer.

Before software-as-a-service, customers would buy software housed on a physical source, such as a compact disc. After purchasing, they would take it home, download it to their computer, and then use it. While this utilization of software was helpful, it was also exceptionally hard for companies to update.

It also wasn’t the most user friendly. For example, if someone was using a tax software before SaaS, they would purchase the software, download it, and input their information. However, every year, they would need to repeat the process in full. Knowing the autofills and recalls of today’s applications, starting from scratch seems tedious and time consuming.

Not to mention that because traditional software is so difficult to update with information, such as the annually revised tax code, for example, users would need to repurchase the software every year.

Software-as-a-service is different in that it doesn’t require customers to purchase software. Instead, users purchase access to software that’s available on the cloud.

What exactly is the cloud? It’s a “a vast network of remote servers around the globe which are hooked together and meant to operate as a single ecosystem,” according to Microsoft.

This type of infrastructure has changed the way software companies administer software, users access and use software, and multiplied the uses and ease of use of software products. For one, SaaS companies can focus on improving their product rather than dedicate energy to producing and marketing new versions. It limits distribution costs like packaging. It also does away with the hassle of administering licenses because the software can only be accessed by paying customers.

It has also changed payments from one-time to subscription-based. While subscription fees are much smaller from month-to-month than the one-time purchase fees previously were, the fees often add up to more than the cost of the software over the course of the year.

For companies, pivoting to SaaS has more perks. Because the functions of SaaS have become so familiar and house a user’s data, switching services is often a hassle despite the minimum software cost. This user data can also be leveraged by companies to test new features.

Why Invest in SaaS?

There have been many success stories in SaaS, from Salesforce to Shopify.

In 2015 at its IPO, Shopify was valued at $1.27 billion. As of spring 2020, it’s valued at $127 billion. Founded by Tobias Lütke and Scott Lake, Shopify started as an online store in 2004 to sell snowboards when they couldn’t find a platform that worked well for them. Now, its e-commerce platform is used by individual sellers and big companies like Google.

And, the industry is poised to keep growing, especially in the wake of COVID-19.

Consider the workforce shift to remote and the Zoom solution, connecting coworkers, families, and even loved ones in nursing homes. Another SaaS platform on the rise is Dynatrace, which provides software intelligence that streamlines user experience and improves business outcomes.

SaaS companies are solving problems from providing e-commerce solutions for businesses, business solutions that are making remote work scenarios work, to giving users access to platforms that help them do everything from monitoring their finances to staying fit to doing their taxes.

As the world adopts new post COVID-19 norms, these new solutions are likely to stay in one form or another.

How to Invest in SaaS

Naturally, in an industry as large and diverse as software, picking winners and losers can be challenging. However, for those investors interested in accessing the segment more broadly, there are a number of ETFs and mutual funds available to help streamline the process. A search on Magnifi suggests that there are many SaaS funds available to choose from.

Unlock a World of Investing with a Magnifi Account

Magnifi is changing the way we shop for investments, with the world’s first semantic search engine for finance that helps users discover, compare and buy investment products such as ETFs, mutual funds and stocks. Open a Magnifi investment account today.

The information and data are as of the June 17, 2021 (publish date) unless otherwise noted and subject to change. This blog is sponsored by Magnifi.

Direct Listing

Once uncharted territory, pursuing a direct listing is becoming less and less an anomaly. “An IPO is no longer a one-size-fits-all path to public,” according to the New York Stock Exchange.

A series of recent high-profile IPO failures of companies valued sky-high in the public eye have proven that a successful IPO isn’t guaranteed. Companies like Uber, Lyft, Endeavor, and Peloton all had highly anticipated IPOs that ended in failure. For example, on its first day of trading, Peloton’s stock plunged 11%. Uber’s shares dropped more than 7% on opening day in May 2019, continuing to slide. (Since then, it has recovered to nearly its introductory value.) At the eleventh hour (the day before it was scheduled), Endeavor decided not to go forward with its IPO. What was once the “only way” to go public is proving more and more not to be a foolproof step forward.

This series of public, lackluster performance seems to be a cautionary tale. And, while a direct public offering sounds fret with opportunities for things to go wrong, high-profile companies like Spotify and Slack are proving otherwise.

Here’s what you should know.

What Is a Direct Listing?

A direct listing or DPO (direct public offering) is a less conventional way to go public. What makes a direct listing so unusual? First, it allows companies to go public without raising capital, making it much different than an initial public offering (IPO).

In an initial public offering (IPO), companies establish an initial public stock price. By offering public ownership, IPOs are able to raise capital from public investors. To do so, a company will offer a certain amount of new and/or existing shares to investors.

Typically, stocks are sold by one or more banks that act as underwriters. These banks also help to market the company, including to institutional investors on a “roadshow” to the tune of millions of dollars. Institutional investors then filter the shares to the larger market, such as the NYSE, for example. In this somewhat exclusive process, only then do the shares become truly available to the public.

Following the IPO big debut, early investors are typically barred from selling their shares for 90 to 180 days, also known as a “lock-up period.” This has the potential to limit how much money those investors can make on the sale of their stock, which is determined by how the price of the stock fares in the public market.

A DPO skips the step of working with an investment bank to underwrite the issue of stock. Rather, “existing stakeholders basically sell their shares to new investors.” In other words, the company doesn’t have to go through the hoops of marketing the company or selling stock to raise cash before the stock goes public. This makes it faster and less expensive than a traditional IPO. It also equalizes the playing field because the stock is openly listed on the market, therefore accessible to everyone.

It should be stated that once a company is listed, even by way of DPO, the company then becomes subject to the “reporting and governance requirements applicable to publicly traded companies” as mandated by the Security Exchange Commission.

Why Are More and More Companies Choosing DPOs?

By using the less conventional DPO, companies can save a lot of cash— by skipping the IPO process, there is no need to pay banks huge underwriting fees.

But, even though there are major cost savings, DPOs are not ideal for every company. What happens if the stock for your little-known company arrives on public markets and no one knows what your company is?

The likelihood is, no one will buy it.

And, without the IPO process, there’s no initial price established by underwriters. For this reason, companies that pursue a DPO generally have better luck if they have “a lot of money and brand recognition.

Another major perk of a DPO is that there is no lock-up period. For early investors, including employees who may have accepted shares in the early days of a company to offset for a lower startup salary, the opportunity to sell shares right away when the stock might hold the most value is a huge perk.

To this point, because no new shares are created in advance of trading, the dilution of existing stock value is prevented.

DPOs are not without risk, however. For one, price volatility, even in the best of circumstances, can be enough to scare companies off. In a DPO, a reference price is typically established by “buy and sell orders collected by the applicable exchange from various broker-dealers.” However, without the support of underwriters who set an initial price, the stock becomes dependent on market conditions and demand.

Moreover, because the number of shares available on the market in a DPO is determined by the number of shares that employees and investors choose to list, there can be less control overall.

Consider Spotify, which successfully pursued a DPO. The stock hit the market at $165.90 in April 2018. On its introductory day, Spotify was ready with a reference price of $132. Even though it had plenty of brand recognition, there was worry that shares flooding the market without a price established by underwriters could lead to a steep fall.

On its first day on the market, it closed at $149. A little more than two years later, the stock is currently trading at $260.44.

Spotify is not alone in its DPO success, though. Slack had similar success after its direct listing in June 2019.

If an IPO seemed like the bar for startup success before, that’s no longer the case. Earlier this spring, Asana filed to go public via direct listing. Other companies that have been rumored to pursue a direct listing include DoorDash, Airbnb and GitLab. Needless to say, looking forward, it is quite possible (if not probable) that the DPO approach becomes a well-traveled path for companies aspiring to go public.

Investing in Direct Listings

For investors, there is functionally little difference between buying shares in an IPO vs. a direct listing. The difference comes in the source of those shares and the way they are priced at the start.

By converting insider ownership shares into publicly-listed stock, pricing on a direct listing can be volatile and a difficult way to access new companies. For investors looking to get into the IPO and DPO market without taking this risk, a search on Magnifi suggests that there are a number of different options in ETFs and mutual funds.

Unlock a World of Investing with a Magnifi Account

Magnifi is changing the way we shop for investments, with the world’s first semantic search engine for finance that helps users discover, compare and buy investment products such as ETFs, mutual funds and stocks. Open a Magnifi investment account today.

The information and data are as of the August 4, 2020 (publish date) unless otherwise noted and subject to change. This blog is sponsored by Magnifi.

Ecommerce

Through the third quarter of 2020, consumers spent $580 billion online with U.S. retailers according to the U.S. Department of Commerce. Naturally, the fact that millions of Americans were sitting at home during the COVID-19 pandemic had a lot to do with this, but those big numbers were already trending higher. From Amazon, to Ebay, to Shopify, more people than ever are buying and selling online than ever before.

Most consumers know all too well that buying in an instant is easier than ever—from essentials like paper towels to novelties like birthday gifts to splurges like home décor and clothes. And, it seems one purchase always leads to the next, especially because of the carefully curated advertisements and reminders that are automatically triggered by online retail platforms to pop up on our screens.

Here is the short story of how the ecommerce we know on our screens today came to be in a relatively short period of time and why it’s both ever improving and here to stay.

What Is Ecommerce?

Electronic commerce, typically known as ecommerce, refers to the “buying and selling of goods, products, or services over the internet.” It extends beyond the transaction of money to funds and data. Think software subscriptions, streaming services, and data storage, to name a few.

Online shopping as we know it was later thought up by Michael Aldrich in the United Kingdom in 1979. Aldrich dreamed of buying his weekly groceries remotely (something that is all too familiar now) while on a walk with his wife. He accomplished this in a way by connecting a television to a transaction processing computer with a telephone line. He called it “teleshopping,” which referred to shopping at a distance.

Still, the first secure, official online retail transaction didn’t take place until in 1994 when a group of cyberspace entrepreneurs sold a Sting CD from one member to another. The transaction successfully utilized data encryption software to ensure data privacy, which was crucial to the adoption of online shopping.

That same year, in 1994, ecommerce giant, Amazon, launched. Since then, the “e-tailer” founded by Jeff Bezos has grown into the world’s largest online retailer; one that currently dominates B2C ecommerce. Originally selling only books, Bezos’s operation was doing $20,000 per week in sales within 30 days of launch.

Since then, the security, ease of use, and convenience, safety, and user experience of ecommerce have all improved exponentially. These improved factors have made ecommerce a viable and profitable new frontier for businesses large and small.

There are generally four types of ecommerce models. These include direct sellers, which operate similar to a physical store for customers but with transactions taking place online (Amazon and Wayfair); marketplaces, which offer platforms for buyers and sellers to connect (think Etsy); software providers, which sell subscriptions to cloud-based software; and logistics, which deliver goods (like UPS and FedEx). Within these four types, ecommerce generally happens one of six ways— Business-to-Business (B2B), Business-to-Consumer (B2C), Consumer-to-Consumer (C2C), Consumer-to-Business (C2B), Business-to-Administration (B2A) and Consumer-to-Administration (C2A).

Why Invest in Ecommerce?

Purchasing habits are changing with more Americans making purchases online than ever before. And, companies are listening by continuing to expand their technology budgets, which are up 4.2% in 2020 over 2019, in part with the shared goal to improve ecommerce sites and boost online sales.

More than ever, consumers are comfortable using their payment information in secure online platforms. According to a study by Price Waterhouse Coopers, more than half (51%) of respondents paid bills and invoices online in 2018, demonstrating an increasing comfort level with buying and completing transactions online.

Sellers aren’t shying away from the internet either, with numerous benefits for new ecommerce-based entities and traditional brick and mortar establishments alike. From the ability to be open for business and thereby make money 24/7 in an online platform, to providing an online space to accurately describe products in detail, to using SEO to attract consumers, selling online is giving retailers the opportunity to communicate better with customers, reach more people, sell more products, and be more successful.

In other words, the technology that facilitates the buying and selling of goods online, not to mention the companies selling more than ever online, offers extensive investment opportunities. Rest assured, online retail, and business generally, is poised to continue its pattern of growth and innovation.

How to Invest in Ecommerce

Naturally, in something as broad as ecommerce, investing isn’t as simple as choosing a few companies. In order to reach the full scope of this trend it’s important to invest broadly in all of the different sectors and niches that are shaping and being reshaped by this shift. Fortunately, a search on Magnifi suggests that there are a number of ETFs and mutual funds that cover ecommerce.

Unlock a World of Investing

with a Magnifi Account

Magnifi is changing the way we shop for investments, with the world’s first semantic search engine for finance that helps users discover, compare and buy investment products such as ETFs, mutual funds and stocks. Open a Magnifi investment account today.

The information and data are as of the July 28, 2020 (publish date) unless otherwise noted and subject to change. This blog is sponsored by Magnifi.

Automation

If automation makes you think about robots, you aren’t alone. But, while smart robotics is a major part of the industry, that’s not all there is to automation anymore.

For example, how was your company’s most recent email campaign sent? It is unlikely that each email was sent one by one. Instead, the send was probably automated using an email service that leveraged a database of information to deliver specifically crafted emails to a designated target audience.

What about your most recent hire? Did you review resumes by searching for keywords on paper from file folders, marking each with a highlighter? The likelihood is that your company used an automated hiring and recruitment tool that allowed them to search keywords in a convenient toolbar.

When you scheduled your last meeting with a handful of coworkers, did you review each of their calendars individually and log their availability in a notebook? Or, did you send a Doodle?

This even extends to operations. Is your customer service team still the front line for all of your customers’ questions. Likely, no. It’s highly probable that your customer service team utilizes a chatbot that has some intelligence capabilities. This function allows them to be more agile, responding promptly and completely to customers with concerns that need to be directly addressed at all hours of the day and night.

These functions weren’t performed by humans or robots. Instead, they were executed by a business application of automation technology.

What Is Automation?

The traditional definition of automation is “the technique of making an apparatus, a process, or a system operate automatically.” According to the International Society of Automation, however, automation is “the creation and application of technology to monitor and control the production and delivery of products and services.”

In short, it’s using mechanized systems to perform tasks that would otherwise be done by people. By cutting out the human operator, automation can help cut down on errors, add new efficiencies to processes, increase productivity, reduce labor, improve safety and lead to higher profits.

Today, automation is becoming increasingly intelligent and effective. This is helping it turn up in businesses in ways that are less than obvious.

Like in the example above, a chatbot answering a customer question rather than a person is one business application of automation technology. But it can be much more than that. Automation is also the intelligence that results in linking the right information to the right person or product. This is particularly important in manufacturing.

Emerson, an electrical multinational company based in Missouri, for example, offers a product called the PlantWeb digital ecosystem. The system improves performance by collecting and synthesizing data from equipment and processes, and then delivering it to the most appropriate human for intervention.

Similarly, consider Zebra Technologies Corp, which offers software and tracking services. It’s technology has applications that improve services across industries including retail, warehouse and distribution, healthcare, manufacturing, transportation and logistics, hospitality, energy and utilities, and the public sector. Recently, it introduced SmartSight, an intelligent automation solution that can spot errors on retail and warehouse shelves and prescribe solutions.

In the retail space, Amazon’s analysis of prior customer purchases and its suggestions of additional products that each customer might consider as they complete their online order. Certainly, a person isn’t behind the scenes drafting a “might like” list. Instead, it’s all automated, and it’s usually fairly accurate.

But that’s just the beginning. Automation technology is also enabling augmented intelligence, where artificial intelligence and machine learning are combined to deliver new cognitive systems that go beyond what humans could accomplish working on their own. According to PwC, these systems can be used to “augment human-driven processes such as data manipulation, exception management and continuous straight-through processing improvement unlocking the value across all areas of the business.”

By layering together automation with these intelligent technologies, organizations are able to transform how they work, how they deliver services, and how they scale their businesses.

Why Invest in Automation?

Automation is making things work better all around us. It reduces costs, increases productivity, increases reliability, reduces bottlenecks, and increases overall performance. Most importantly, automation is becoming increasingly accessible to small businesses thanks to the flexibility and lower cost of cloud-based platforms and services.

As of 2018, the automation market was estimated to be worth as much as $160 billion, on track to grow nearly 12% per year through at least 2025. Much of this growth is happening in Asia, the world’s manufacturing center, which owned 32% of the total automation market as of 2018. According to the International Monetary Fund, there are roughly 1 million robots currently at work in Asia, accounting for 67% of global industrial robot usage.

Much of the growth in the automation market is expected to happen in 3D printing, where automated printers are already being used to produce machine parts, and nanomanufacturing, where automation is helping produce solar cells, batteries and other tiny manufactured parts.

Manufacturers of all sizes, for example, are increasingly using automation to evaluate the efficiency of their processes. Automation gathers data from designated equipment, compares the gathered information to a set of ideals, and then suggests actions to be taken to achieve desired results.

In HR settings, even the simple ability to autofill data rather than manually enter it both improves efficiency and reduces the opportunity for human error. When harnessed, it should be a “driver of growth and job creation, including in new occupations and industries never before imagined,” according to the Aspen Institute.

How to Invest in Automation

Investing in automation technology doesn’t have to mean picking the next big company with the most advanced robotics. Automation-related ETFs exist and include the Robo Global Robotics & Automation ETF, which has over $2 billion in assets. These allow investors to have diverse holdings in automation advances.

After all, given the rapid growth of the automation sector, investing in one particular company can be risky. Finding ETFs and mutual funds that offer exposure to this fast-growing sector as a whole is a better gain to gain exposure to the technology as a whole as it continues to develop and evolve. A search on Magnifi suggests there are a number of different ways for investors to do this.

Unlock a World of Investing with a Magnifi Account

Magnifi is changing the way we shop for investments, with the world’s first semantic search engine for finance that helps users discover, compare and buy investment products such as ETFs, mutual funds and stocks. Open a Magnifi investment account today.

The information and data are as of the June 29, 2020 (publish date) unless otherwise noted and subject to change. This blog is sponsored by Magnifi.

Biotech

If you are the sort of person who enjoys a cold beer after a long day, it may surprise you to learn that the beverage in your hand is a product of biotechnology.

Really.

That’s because, in the case of beer, brewers harness the biological power of yeast to produce alcohol through fermentation. Brewing is among the oldest known examples of humans harnessing natural biological processes to create something new, and modern biotech is simply a more advanced version of this ancient practice.

Modern biotech really took off in the 1970s following scientific breakthroughs in the field of genetic engineering. By combining DNA from two different organisms and inserting the new hybrid DNA into a host cell, scientists harnessed the natural process of DNA replication to produce large quantities of hybrid molecules. This technology, known as recombinant DNA technology, revolutionized biology and ushered in a new era of possibilities in which complex new substances could be synthesized in quantities sufficient to benefit mankind.

For example, Genentech, an early pioneer in biotech, used recombinant DNA technology to develop a process for creating synthetic human insulin in the early 1980s. Prior to Genentech’s breakthrough, diabetics had to take insulin derived from the pancreas’ of pigs and cattle.

Another major biotech breakthrough happened when Monsanto, an agrochemical company, introduced “Roundup Ready” crops in 1996. Monsanto genetically engineered Roundup Ready crops to be resistant to the highly-effective herbicide Roundup, which Monsanto had been selling since the 1970s. Farmers could buy Roundup Ready seeds from Monsanto and apply Roundup herbicide to their fields and the Roundup would kill all plants except the Roundup Ready crops, making the task of weed control significantly easier.

Big advances in biotech have been met with a combination of excitement and concern over the years, but the transformative potential of new discoveries is undeniable.

For those interested in the investment potential of this innovative industry, there are a few important points to understand.

What is biotech?

At the highest level, biotechnology (or “biotech”) is defined as the use of biology to solve problems and make useful products. This involves the use of biology to solve problems and make useful products. Modern biotech encompasses a wide range of products and technologies.

As an industry, biotech can generally be divided into three sub-industries: biopharmaceuticals, agricultural biotech, and industrial biotech.

The biopharmaceutical (aka biopharma) industry focuses on developing new drugs through genetic engineering, such as with Genentech’s development of synthetic insulin. Biopharma drugs are composed of molecules that are larger and more complex than traditional pharmaceuticals. These complex drugs have enormous potential for disease treatment because they are highly-effective and cause few side effects.

The agricultural biotech industry focuses on developing new agricultural products through genetic engineering, such as with Monsanto’s development of herbicide-resistant crops. Agricultural biotech aims to make agriculture more efficient by improving crop yields, making crops less susceptible to pests and disease, and improving the nutritional value in food.

Lastly, the industrial biotech industry focuses on harnessing the power of biological processes such as fermentation to produce energy and make industrial processes more efficient. For example, ethanol is a biofuel that is produced by fermenting corn, and it is added to gasoline to reduce air pollution. Many scientists are hopeful that further development of biofuel technology will play an important role in combating climate change.

While people tend to associate biotech primarily with the healthcare sector, it is important to note that biotech has a wide variety of innovative applications across numerous industries.

Why invest in biotech

As an industry, biotech offers a rare opportunity in this turbulent market because it outperforms the market in recessions and the evolution of healthcare points to long-term growth.

In the recessions of 2001 and 2008-2009, biotech outperformed the S&P by an average of 18%. Even with the S&P’s recovery in recent months, the index is still down about 5% for the year as of mid-June, while the largest and oldest biotech ETF, iShares Nasdaq Biotechnology ETF (IBB), is up about 12%.

Stepping away from short-term volatility, Polaris Market Research projects that the industry will see a compound annual growth rate of about 7% over the next several years. The need to develop innovative treatments to challenging diseases is seen as the primary force driving this long-term growth.

Hanging over this entire discussion of performance is, of course, the impact of COVID-19. Biotech companies are in a race to develop a vaccine for COVID-19, and some companies, such as Moderna, are seeing massive gains after reporting positive results.

How to invest in biotech

The key point to keep in mind when looking at biotech investing is accurately gauging risk tolerance. Biotech is a volatile place to invest in the best of times, and these are not the best of times. Companies spend years and billions of dollars developing treatments, and the reality is that not every treatment works or is approved.

Investors interested in the massive potential of biotech would do well to do their homework and honestly assess their appetite for wild price swings. Biotech looks to have a bright future, and the industry does have a history of beating the market, but it is important to understand that it comes at the cost of high volatility.

That’s why investing in a biotech-focused ETF or mutual fund is a good way to gain exposure to this growing but volatile sector. A search on Magnifi suggests there are a number of different ways for investors to do this.

Unlock a World of Investing with a Investment Account

Magnifi is changing the way we shop for investments, with the world’s first semantic search engine for finance that helps users discover, compare and buy investment products such as ETFs, mutual funds and stocks. Open a Magnifi investment account today.

The information and data are as of the June 24, 2020 (publish date) unless otherwise noted and subject to change. This blog is sponsored by Magnifi.