Utilities

We turn on the water faucet every morning to brush our teeth and make our coffee. We click on the oven or the stovetop burner to cook our meals. We power up the heat when the air outside starts to chill or the AC on when the weather warms up. And then, like clockwork at the end of every month, we pay each of our utility bills.

Most of the time, utilities don’t come with many surprises. And, while costs always seem to go up, it’s usually a little bit at a time. But you likely already know this. Utilities are just part of life. Still, it’s possible that you’ve never considered the following: what would it look like if you invested in your utility services and they paid you like clockwork, as well?

Utility investments offer a unique way to diversify a portfolio— providing stability and returns almost as predictable as your monthly bill. Here’s why you should consider a utility-related investment product before your next billing cycle.

What qualifies as ‘utilities’?

Utilities include electricity, natural gas, and water and waste services.

American Water Works (NYSE:AWK), for example, is the largest publicly traded water and wastewater utility in the U.S. Through its subsidiaries, it services approximately 3.4 million active customers in 16 states. Over the last three years, it managed to grow its earnings per share by 9.1% per year, over three years. This past year, its revenue grew by 4.3% to US$3.6b.

The utility sector increasingly includes wind and solar. For example, NextEra Energy (NEE), which invests in renewable energy infrastructure, has performed well overall since its market debut.

At one-point telephone and cable companies were strictly regarded as utilities. In some cases, they still are (specifically landline services). But, improved technology and a changing, increasingly competitive market is transitioning them to part of the communications sector rather than a public utility.

Utilities, including electricity, natural gas, and water and waste services, typically have monopolies in the geographic regions that they serve. In part this is because the cost of building and maintaining a power plant, a grid network required for distribution of electricity, etc., and the customer service infrastructure to collect payments and meet the needs of mass users is expensive.

While the stability of no competition and a reliable customer base generally means that utilities are less impacted by economic downturns than other companies, it also means that they are regulated.

Regulation means that a government entity at the local, regional, and/or federal level participates in oversight. Typically, oversight would include the monitoring of utility rates for customers, regional growth rates, and service reliability. It limits the ability to easily make rate increases to adjust for a profit margin, for example, requiring that price increases be both necessary and approved.

Why invest in utilities?

Utilities are not a choice investment for making fast cash, rather they are a great way to diversify your portfolio. Considered a defensive investment, utilities can be a great tool to reduce overall risk. Utilities are generally regarded as a safe investment, more correlated with bonds than stocks, for a couple of reasons.

First, because utilities participate in a regulated industry, competition is generally stable and limited. They also rarely go out of business and because they have consistent customers who don’t have other options, they tend to have consistent revenue.

Second, because they are regulated entities, they have very predictable cash flow and profits. This allows utilities to pay consistent dividends, generating steady income for investors. They also pay relatively high dividends (typically 60 to 80 percent of their annual earnings) to shareholders in part because they have little need to reinvest earnings into operations. The need for energy resources to power our refrigerators, water from our sinks, etc. is all consistent regardless of the strength of the economy.

Investing in utilities that offer wind and solar opportunities can also provide a way for investors interested in environmental, social and governance to financially support companies aligned with sustainable values.

How to invest in utilities

Because of their infrastructure requirements, however, utilities tend to carry a lot of debt. This makes them vulnerable to rising interest rates. Higher interest rates both typically lower stock prices and increase debt for utility companies.

There are a number of ways to invest in utilities, but it’s most often wise to look for a mutual fund, exchange-traded fund, or company with diversified holdings. Diversification limits some degree of risk in the case of a natural disaster that damages infrastructure, for example.

However, utility-focused ETFs and mutual funds are a good way to access this sector without investing directly in individual utility providers. A search on Magnifi suggests there are a few different ways to do this.

Unlock a World of Investing

with a Magnifi Investment Account

Magnifi is changing the way we shop for investments, with the world’s first semantic search engine for finance that helps users discover, compare and buy investment products such as ETFs, mutual funds and stocks. Open a Magnifi investment account today.

The information and data are as of the June 30, 2020 (publish date) unless otherwise noted and subject to change. This blog is sponsored by Magnifi.

Automation

If automation makes you think about robots, you aren’t alone. But, while smart robotics is a major part of the industry, that’s not all there is to automation anymore.

For example, how was your company’s most recent email campaign sent? It is unlikely that each email was sent one by one. Instead, the send was probably automated using an email service that leveraged a database of information to deliver specifically crafted emails to a designated target audience.

What about your most recent hire? Did you review resumes by searching for keywords on paper from file folders, marking each with a highlighter? The likelihood is that your company used an automated hiring and recruitment tool that allowed them to search keywords in a convenient toolbar.

When you scheduled your last meeting with a handful of coworkers, did you review each of their calendars individually and log their availability in a notebook? Or, did you send a Doodle?

This even extends to operations. Is your customer service team still the front line for all of your customers’ questions. Likely, no. It’s highly probable that your customer service team utilizes a chatbot that has some intelligence capabilities. This function allows them to be more agile, responding promptly and completely to customers with concerns that need to be directly addressed at all hours of the day and night.

These functions weren’t performed by humans or robots. Instead, they were executed by a business application of automation technology.

What Is Automation?

The traditional definition of automation is “the technique of making an apparatus, a process, or a system operate automatically.” According to the International Society of Automation, however, automation is “the creation and application of technology to monitor and control the production and delivery of products and services.”

In short, it’s using mechanized systems to perform tasks that would otherwise be done by people. By cutting out the human operator, automation can help cut down on errors, add new efficiencies to processes, increase productivity, reduce labor, improve safety and lead to higher profits.

Today, automation is becoming increasingly intelligent and effective. This is helping it turn up in businesses in ways that are less than obvious.

Like in the example above, a chatbot answering a customer question rather than a person is one business application of automation technology. But it can be much more than that. Automation is also the intelligence that results in linking the right information to the right person or product. This is particularly important in manufacturing.

Emerson, an electrical multinational company based in Missouri, for example, offers a product called the PlantWeb digital ecosystem. The system improves performance by collecting and synthesizing data from equipment and processes, and then delivering it to the most appropriate human for intervention.

Similarly, consider Zebra Technologies Corp, which offers software and tracking services. It’s technology has applications that improve services across industries including retail, warehouse and distribution, healthcare, manufacturing, transportation and logistics, hospitality, energy and utilities, and the public sector. Recently, it introduced SmartSight, an intelligent automation solution that can spot errors on retail and warehouse shelves and prescribe solutions.

In the retail space, Amazon’s analysis of prior customer purchases and its suggestions of additional products that each customer might consider as they complete their online order. Certainly, a person isn’t behind the scenes drafting a “might like” list. Instead, it’s all automated, and it’s usually fairly accurate.

But that’s just the beginning. Automation technology is also enabling augmented intelligence, where artificial intelligence and machine learning are combined to deliver new cognitive systems that go beyond what humans could accomplish working on their own. According to PwC, these systems can be used to “augment human-driven processes such as data manipulation, exception management and continuous straight-through processing improvement unlocking the value across all areas of the business.”

By layering together automation with these intelligent technologies, organizations are able to transform how they work, how they deliver services, and how they scale their businesses.

Why Invest in Automation?

Automation is making things work better all around us. It reduces costs, increases productivity, increases reliability, reduces bottlenecks, and increases overall performance. Most importantly, automation is becoming increasingly accessible to small businesses thanks to the flexibility and lower cost of cloud-based platforms and services.

As of 2018, the automation market was estimated to be worth as much as $160 billion, on track to grow nearly 12% per year through at least 2025. Much of this growth is happening in Asia, the world’s manufacturing center, which owned 32% of the total automation market as of 2018. According to the International Monetary Fund, there are roughly 1 million robots currently at work in Asia, accounting for 67% of global industrial robot usage.

Much of the growth in the automation market is expected to happen in 3D printing, where automated printers are already being used to produce machine parts, and nanomanufacturing, where automation is helping produce solar cells, batteries and other tiny manufactured parts.

Manufacturers of all sizes, for example, are increasingly using automation to evaluate the efficiency of their processes. Automation gathers data from designated equipment, compares the gathered information to a set of ideals, and then suggests actions to be taken to achieve desired results.

In HR settings, even the simple ability to autofill data rather than manually enter it both improves efficiency and reduces the opportunity for human error. When harnessed, it should be a “driver of growth and job creation, including in new occupations and industries never before imagined,” according to the Aspen Institute.

How to Invest in Automation

Investing in automation technology doesn’t have to mean picking the next big company with the most advanced robotics. Automation-related ETFs exist and include the Robo Global Robotics & Automation ETF, which has over $2 billion in assets. These allow investors to have diverse holdings in automation advances.

After all, given the rapid growth of the automation sector, investing in one particular company can be risky. Finding ETFs and mutual funds that offer exposure to this fast-growing sector as a whole is a better gain to gain exposure to the technology as a whole as it continues to develop and evolve. A search on Magnifi suggests there are a number of different ways for investors to do this.

Unlock a World of Investing with a Magnifi Account

Magnifi is changing the way we shop for investments, with the world’s first semantic search engine for finance that helps users discover, compare and buy investment products such as ETFs, mutual funds and stocks. Open a Magnifi investment account today.

The information and data are as of the June 29, 2020 (publish date) unless otherwise noted and subject to change. This blog is sponsored by Magnifi.

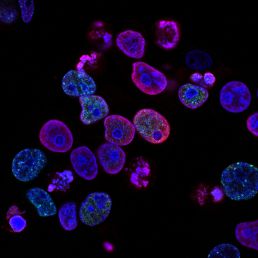

Biotech

If you are the sort of person who enjoys a cold beer after a long day, it may surprise you to learn that the beverage in your hand is a product of biotechnology.

Really.

That’s because, in the case of beer, brewers harness the biological power of yeast to produce alcohol through fermentation. Brewing is among the oldest known examples of humans harnessing natural biological processes to create something new, and modern biotech is simply a more advanced version of this ancient practice.

Modern biotech really took off in the 1970s following scientific breakthroughs in the field of genetic engineering. By combining DNA from two different organisms and inserting the new hybrid DNA into a host cell, scientists harnessed the natural process of DNA replication to produce large quantities of hybrid molecules. This technology, known as recombinant DNA technology, revolutionized biology and ushered in a new era of possibilities in which complex new substances could be synthesized in quantities sufficient to benefit mankind.

For example, Genentech, an early pioneer in biotech, used recombinant DNA technology to develop a process for creating synthetic human insulin in the early 1980s. Prior to Genentech’s breakthrough, diabetics had to take insulin derived from the pancreas’ of pigs and cattle.

Another major biotech breakthrough happened when Monsanto, an agrochemical company, introduced “Roundup Ready” crops in 1996. Monsanto genetically engineered Roundup Ready crops to be resistant to the highly-effective herbicide Roundup, which Monsanto had been selling since the 1970s. Farmers could buy Roundup Ready seeds from Monsanto and apply Roundup herbicide to their fields and the Roundup would kill all plants except the Roundup Ready crops, making the task of weed control significantly easier.

Big advances in biotech have been met with a combination of excitement and concern over the years, but the transformative potential of new discoveries is undeniable.

For those interested in the investment potential of this innovative industry, there are a few important points to understand.

What is biotech?

At the highest level, biotechnology (or “biotech”) is defined as the use of biology to solve problems and make useful products. This involves the use of biology to solve problems and make useful products. Modern biotech encompasses a wide range of products and technologies.

As an industry, biotech can generally be divided into three sub-industries: biopharmaceuticals, agricultural biotech, and industrial biotech.

The biopharmaceutical (aka biopharma) industry focuses on developing new drugs through genetic engineering, such as with Genentech’s development of synthetic insulin. Biopharma drugs are composed of molecules that are larger and more complex than traditional pharmaceuticals. These complex drugs have enormous potential for disease treatment because they are highly-effective and cause few side effects.

The agricultural biotech industry focuses on developing new agricultural products through genetic engineering, such as with Monsanto’s development of herbicide-resistant crops. Agricultural biotech aims to make agriculture more efficient by improving crop yields, making crops less susceptible to pests and disease, and improving the nutritional value in food.

Lastly, the industrial biotech industry focuses on harnessing the power of biological processes such as fermentation to produce energy and make industrial processes more efficient. For example, ethanol is a biofuel that is produced by fermenting corn, and it is added to gasoline to reduce air pollution. Many scientists are hopeful that further development of biofuel technology will play an important role in combating climate change.

While people tend to associate biotech primarily with the healthcare sector, it is important to note that biotech has a wide variety of innovative applications across numerous industries.

Why invest in biotech

As an industry, biotech offers a rare opportunity in this turbulent market because it outperforms the market in recessions and the evolution of healthcare points to long-term growth.

In the recessions of 2001 and 2008-2009, biotech outperformed the S&P by an average of 18%. Even with the S&P’s recovery in recent months, the index is still down about 5% for the year as of mid-June, while the largest and oldest biotech ETF, iShares Nasdaq Biotechnology ETF (IBB), is up about 12%.

Stepping away from short-term volatility, Polaris Market Research projects that the industry will see a compound annual growth rate of about 7% over the next several years. The need to develop innovative treatments to challenging diseases is seen as the primary force driving this long-term growth.

Hanging over this entire discussion of performance is, of course, the impact of COVID-19. Biotech companies are in a race to develop a vaccine for COVID-19, and some companies, such as Moderna, are seeing massive gains after reporting positive results.

How to invest in biotech

The key point to keep in mind when looking at biotech investing is accurately gauging risk tolerance. Biotech is a volatile place to invest in the best of times, and these are not the best of times. Companies spend years and billions of dollars developing treatments, and the reality is that not every treatment works or is approved.

Investors interested in the massive potential of biotech would do well to do their homework and honestly assess their appetite for wild price swings. Biotech looks to have a bright future, and the industry does have a history of beating the market, but it is important to understand that it comes at the cost of high volatility.

That’s why investing in a biotech-focused ETF or mutual fund is a good way to gain exposure to this growing but volatile sector. A search on Magnifi suggests there are a number of different ways for investors to do this.

Unlock a World of Investing with a Investment Account

Magnifi is changing the way we shop for investments, with the world’s first semantic search engine for finance that helps users discover, compare and buy investment products such as ETFs, mutual funds and stocks. Open a Magnifi investment account today.

The information and data are as of the June 24, 2020 (publish date) unless otherwise noted and subject to change. This blog is sponsored by Magnifi.

Precision Medicine

One universal and challenging reality of healthcare is that we all respond differently to different treatments. We’ve all had those frustrating moments when we learn that the medicine we recently tried that made no real improvement on our ailment somehow worked brilliantly for a friend or family member.

The reason for this variability stems from the fact that everyone has unique genetics, lifestyles, and living environments. Our genetic makeup, lifestyle choices, and the physical environment around us all impact how our bodies respond to sickness and medicine.

For instance, a small percentage of the population has an enzyme deficiency due to genetics. People with this deficiency are not able to process drugs called thiopurines, which are used to treat autoimmune disorders, certain types of cancer, and organ transplants.

The traditional approach to medicine involves doctors giving sick patients treatment that works well for most people, and adjusting course if the treatment does not work. This approach may work well enough when the illness is not serious, but it can be downright dangerous if the patient has an aggressive disease and there is not enough time for trial and error treatment.

In response to the limitations of traditional medicine, there is growing interest in a new approach called precision medicine. Unlike traditional medicine, precision medicine approaches treatment from the perspective that all patients are highly unique, and that in order to provide the most effective treatment, doctors need to understand exactly what makes a patient unique.

Precision medicine is a data-driven approach to healthcare, and recent advances in computer science and technology are harnessing data to drive innovation across the healthcare sector. There are significant challenges that need to be addressed before precision medicine can have a global, transformative impact, but leaders throughout healthcare and government are increasingly recognizing precision medicine’s enormous potential to deliver better care faster.

For those interested in the investment potential of this growing industry, there are a few important points to understand.

What Is Precision Medicine?

According to the National Institutes of Health (NIH), precision medicine is “an emerging approach for disease treatment and prevention that takes into account individual variability in genes, environment, and lifestyle for each person.”

The “precision” in precision medicine allows doctors and researchers to more accurately pinpoint which treatments will be most effective for certain people or groups of people.

Three fields that are rapidly driving innovation in precision medicine are genetic testing, pharmacogenomic testing, and medical imaging.

According to the NIH, genetic testing is “a type of medical test that identifies changes in chromosomes, genes, or proteins. The results of a genetic test can confirm or rule out a suspected genetic condition or help determine a person’s chance of developing or passing on a genetic disorder.” Genetic testing is currently used to identify people who are at particular risk for certain types of cancer (such as with the BRCA gene test for breast cancer), and the hope is that in the future, genetic testing will expand into the realm of primary care as a noninvasive screening test for preventive medicine.

Pharmacogenomic testing is a type of genetic test used to figure out how a patient will

respond to certain medications. Our genetic makeup contributes to how we respond to medicine, so pharmacogenomic tests look for clues in our genes to figure out which medications, or what doses of those medications, are likely to work best.

As mentioned earlier, some people have an enzyme deficiency that makes thiopurines ineffective. A pharmacogenomic test for this enzyme deficiency lets the doctor know whether thiopurines are a good course of treatment before treatment begins, rather than adjusting course after complications arise.

Last but not least, medical imaging encompasses the various technologies that allow us to view the human body in order to diagnose, monitor, or treat medical conditions (MRIs, CT scans, etc.). Innovative technological solutions are changing how images are gathered and interpreted.

By harnessing the power of artificial intelligence and deep learning, Intel recently developed technology that was able to identify thyroid nodules in patients with 10% higher accuracy than the radiologists. Innovations in genetic testing, pharmacogenomic testing, and medical imaging are accelerating the expansion of precision medicine in the healthcare ecosystem.

Why Invest in Precision Medicine?

The investment potential in the precision medicine industry is likely substantial, and there are several clear reasons for this.

First, leaders in government are beginning to recognize the enormous potential of precision medicine and are committing substantial resources to support innovation. For instance, President Obama launched the Precision Medicine Initiative (PMI) in 2015 with $215 million in funding to drive research and expand precision medicine across the U.S. healthcare ecosystem. A cornerstone of the PMI is the groundbreaking All of Us Research Program, which plans to enroll and follow a diverse group of at least 1 million people in the U.S. in order to accelerate medical research and improve health.

Government funding aside, the proliferation of direct-to-consumer genetic testing is another driver of precision medicine’s long-term strength. Companies such as 23andMe and Ancestry.com offer genetic testing that provides customers with genealogy and health insights.

Millions of people have taken these at-home genetic tests, and testing companies now sit on mountains of valuable data. That data, when properly (and legally) harnessed, is enormously valuable in developing new drugs.

While precision medicine is clearly going to continue changing the healthcare landscape in the coming years, there are a few challenges that need to be addressed before it becomes a game changer for everyone.

The first challenge is data. Health data is not like other data – it is subject to extensive and strict government regulations (HIPAA in the U.S., for instance). How will companies navigate these complicated data issues as they work to integrate precision medicine solutions?

The next challenge is access. If you are poor or uninsured, precision medicine, as it currently stands, is likely too expensive for you to use. Will prices come down as innovation accelerates, or will governments need to step in to improve access for everyone?

These are questions that thought leaders in healthcare, private industry, and government are thinking about, and they are worth considering if you are interested in investing in precision medicine.

How to Invest in Precision Medicine

Of course, investing in a field as new and innovative as precision medicine comes with its share of risk. As an emerging segment of healthcare, precision medicine is still growing and the companies in this sector are still working out where that can make the biggest impact. With this in mind, investing in precision medicine via an ETF or mutual fund is a good way to access this emerging field without taking on undue risk. A search on Magnifi suggests that there are a number of ways to do this.

Unlock a World of Investing with a Magnifi Investment Account

Magnifi is changing the way we shop for investments, with the world’s first semantic search engine for finance that helps users discover, compare and buy investment products such as ETFs, mutual funds and stocks. Open a Magnifi investment account today.

The information and data are as of the June 16, 2020 (publish date) unless otherwise noted and subject to change. This blog is sponsored by Magnifi.

LGBTQ

Socially conscious investing is on the rise. According to a report by the US SIF Foundation, 1 in 4 assets of the $46.6 trillion in investments professionally managed is invested in socially responsible ways.

Why? More than investing for strictly financial purposes, investors are increasingly considering the social impact that their investments can have. It’s more and more common for investors to want their portfolio to be holistic, putting their money to work to support causes they personally care about.

Also known as socially responsible investing (SRI), this trend is described as investing in companies that have firm ethical practices. Investors can participate in SRI on a range of issues that are important to them, from the environment to social concerns. LGBTQ investments, an emerging trend in the space, have the power to support anti-discrimination measures as they relate to gender identity in the workplace.

For the LGBTQ community, the legalization of gay marriage in 2015 changed finances in many households. From taxes, to retirement planning and pensions, marriage equality made partners into formally recognized households and more aligned financial partners.

And, this community has money to invest. According to LGBT Capital, LGBTQ household wealth is estimated at $18 trillion globally, approximately $6 trillion of which is in the United States.

For these reasons and more, investing in companies that are explicitly supportive of the equality of the LGBTQ community is a growing trend that’s here to stay.

What Is LGBTQ Investing?

LGBTQ investing is using investments to advance social equity, specifically by supporting publicly traded companies that support anti-discrimination measures related to sexual orientation, gender identity, and gender expression.

Offerings that have both an ethical and financial concern have a long history and are still expanding.

Environmental, social and governance (ESG) factors address non-traditional issues as a key part of financial analysis. First coined in 2005 by the study “Who Cares Wins,” ESG factors include how a corporation handles environmental stewardship, treats its employees, manages supply chains, and more.

ESG, while newer than Socially Responsible Investment (SRI), builds upon it and states that corporations that practice ESG are better poised to compete successfully. Around the same time of the “Who Cares Wins” report, the UNEP published the “Freshfield Report” which demonstrated more specifically how ESG factors are relevant to financial valuation.

Soon after these reports in 2006, the Principles for Responsible Investment (PRI), a voluntary set of investment principals, were launched by the New York Stock Exchange followed by the Sustainable Stock Exchange Initiative (SSEI) in 2007.

These initiatives speak to the core interest of investors in investing in companies that have values that align with their own.

In the meantime, in 2002, the Corporate Equality Index (CEI) was introduced by the Human Rights Campaign Foundation. Its purpose is to rate the LGBTQ-inclusivity of businesses from 1 to 100. This is a helpful tool both for companies wanting to know how they stack up and investors with a commitment to supporting the advancement of LGBTQ inclusivity.

It’s been shown that companies with more pro-employee policies tend to have better performance, making LGBTQ equality a relevant ESG factor. In this space, specific workplace benefits identified by the CEI include domestic partner benefits, transgender-inclusive benefits, employee resource groups, and public commitment to the LGBTQ community.

According to the CEI 2020 report, 91 percent of Fortune 500 companies (including those who participate in the survey and those that do not) include gender identity protections in their nondiscrimination policies. This is up from just 3 percent in 2002.

And while environmental stewardship might be a more traditional ESG factor, LGBTQ equality is an example of an increasingly relevant and popular ESG factor.

How to Invest in LGBTQ?

In 2018, UBS launched a fund that matches investors with companies that “respect, protect and encourage their lesbian, gay, bisexual and transgender employees.”

Investment portfolios are increasingly versatile tools depending on investor criteria. LGBTQ investments can be incorporated into portfolios in a variety of ways, from meeting specific criteria to more broadly supporting the community.

According to the Corporate Equality Index (CEI) the top ten companies according to the 2020 index are (1) Walmart Inc., (2) Exxon Mobil Corp. (3) Berkshire Hathaway, (4) Apple Inc., (5) UnitedHealth Group Inc., (6) McKesson Corp., (7) CVS Health Corp., (8) Amazon.com Inc., (9) AT&T Inc., and (10) General Motors Co.

The corporate world is becoming more inclusive. Now more than ever, investing in LGBTQ is a matter of choosing to be aware of which companies are explicitly inclusive, and putting your money there.

Of course, investing in companies based on social issues isn’t easy, as different companies take different approaches to these concerns and often their businesses are not directly related to them. However, ETFs and mutual funds focused on social and equality issues are a good way to access this growing sector without having to invest directly in specific companies. A search on Magnifi suggests there are a few different ways to do this.

Unlock a World of Investing with a Magnifi Account

Magnifi is changing the way we shop for investments, with the world’s first semantic search engine for finance that helps users discover, compare and buy investment products such as ETFs, mutual funds and stocks. Open a Magnifi investment account today.

The information and data are as of the June 15, 2020 (publish date) unless otherwise noted and subject to change. This blog is sponsored by Magnifi.

Medical Devices

When we think “medical device,” we might automatically think of the beeping equipment in a hospital room. But, in today’s world, medical devices are much more— perhaps even closer to science fiction than traditional science.

The medical device market is anticipated to reach $432.6 billion by 2025, according to a recent report published by Lucintel.

In part, this growth is driven by the increasing sophistication of technology. Medical devices are becoming smaller and smarter than ever, performing increasingly complex and constantly improving functions.

[What else is happening in healthcare? Here’s Magnifi’s take.]

Moreover, escalating healthcare costs, a rise in chronic diseases, and a growing aging population are compelling health care providers to seek out new, more efficient care models. From 3D printing human tissues to monitoring patients according to their specific clinical needs after they leave the hospital, innovative medical devices are meeting that need.

New medical devices are offering a myriad of useful answers to complex health challenges, changing the reality of care in new and exciting ways.

What Are Medical Devices?

According to the World Health Organization, ‘medical device’ means any instrument, apparatus, implement, machine, appliance, implant, reagent for in vitro use, software, material or other similar or related article, intended by the manufacturer to be used, alone or in combination, for human beings, for one or more of the specific medical purpose(s) of:

- diagnosis, prevention, monitoring, treatment or alleviation of disease,

- diagnosis, monitoring, treatment, alleviation of or compensation for an injury,

- investigation, replacement, modification, or support of the anatomy or of a physiological process,

- supporting or sustaining life,

- control of conception,

- disinfection of medical devices

- providing information by means of in vitro examination of specimens derived from the human body;

and does not achieve its primary intended action by pharmacological, immunological or metabolic means, in or on the human body, but which may be assisted in its intended function by such means.

So, health monitors, check. Brain sensors, check. 3D printed prosthetics (and ears!), check again.

Why Invest in Medical Devices?

The landscape of medical devices is growing rapidly, with technology making the impossible possible.

Wearables

The rise in wearables isn’t limited to FitBits. And when it comes to medical devices, wearables do much more than measure your steps. For one, wearables can offer real-time patient data to health care providers. And, when they connect with Artificial Intelligence-based programs, they not only collect information, but also analyze it against big data.

Up-to-minute information about vitals limits the need for in-person appointments and can lead to better patient outcomes. For example, Current Health’s Remote Patient Monitoring Platform is AI powered and customizable according to a patient’s risk level.

Some emerging wearables can also perform health interventions. In early 2019, the U.S. Food and Drug Administration (FDA),approved the first wearable, portable peritoneal dialysis. Developed by Singapore-based AWAK Technologies, the device has the potential to change the lives of dialysis patients around the world.

Perhaps even more exciting, researchers at the University of Michigan have developed a wrist-worn prototype that screens the wearer’s blood over the course of a few hours, analyzing it for circulating tumor cells (CTCs).

Wearables can be used for everything from pre-surgical planning to gene sequencing and medical imaging, making their health and investment opportunities plentiful.

Brain Sensors

These days, brain sensors come in many shapes and sizes. Some are placed in the brain itself, measuring temperature and pressure before dissolving. This information can be crucial for patients with traumatic brain injuries, for example. Their dissolvable nature not only negates the need for surgery to remove them, but also limits the risk of infection and complications associated with long-term implants.

Alternatively, the company Advanced Brain Monitoring offers products designed to track function as it relates to chronic diseases and early stage neurodegeneration.

Still others are more consumer oriented, like the company Muse, which sells headsets that act as a brain fitness tool, measuring and tracking brain activity.

Artificial Organs

Certainly many things — like the heart — can’t be replicated. Right? Actually, that’s not entirely true anymore.

iSynCardia Systems recently received FDA approval for its most recent iteration of a total artificial heart, the 50cc temporary Total Artificial Heart System (50cc TAH-t).The company’s artificial heart, first approved in 2004, is meant to be a bridge until a biological donor becomes available. Artificial organs, whether printed or made otherwise, offer a lot of promise, providing millions waiting on donor organs an alternative.

3D Printing

According to the FDA, “3D printing is a process that creates a three-dimensional object by building successive layers of raw material.”

Not only does 3D printing allow for the creation of more patient-specific devices, it allows for more specific variation in medical tools. Rather than buying large quantities of a tool, providers can print them on demand. Similarly, customized prosthetics and orthopedic implants are more possible than ever, improving the likelihood of patient success.

Bioprinting

Now, for the real science fiction stuff.

Bioprinting uses carefully designed bio inks made of biomaterials and cells to 3D print living obstacles, such as tissue or organ. Pioneered a decade ago, bioprinting in its early days was developed to improve wound reconstruction related to burns, one of the most common types of traumas worldwide. Since then, scientists have gone as far as to develop a prototype of a handheld bioprinter designed specifically to help skin regenerate in areas affected by large wounds.

Beyond skin, scientists have succeeded in bioprinting an artificial pancreas, a synthetic ear, a meniscus made in space, and even bone tissue. Researchers are even working on bio-printed ovaries for women suffering from infertility.

How to Invest in Medical Devices

As an emerging industry, particularly one in the feast or famine sector of biotech, investing in medical devices directly can be risky. Although medical devices on the whole have been around for decades, the innovative new solutions at the forefront of the industry remain largely untested. This can make investing in individual medical device companies a risky proposition.

However, a search on Magnifi indicates that there are a number of ETFs and mutual funds available to give investors broad exposure to this industry without concentrating their bets on any one company.

Unlock a World of Investing with a Magnifi Account

Magnifi is changing the way we shop for investments, with the world’s first semantic search engine for finance that helps users discover, compare and buy investment products such as ETFs, mutual funds and stocks. Open a Magnifi investment account today.

The information and data are as of the June 11, 2020 (publish date) unless otherwise noted and subject to change. This blog is sponsored by Magnifi.

Healthcare

Make no mistake, the COVID-19 pandemic has been a wake-up call for millions of people around the world. Suddenly, maintaining our health is the most important thing on our minds, overtaking all of the usual daily tasks like work, school and entertainment.

Economies have shut down, governments have scrambled to adapt and we’re still not yet sure what the world will look like on the other side of this.

But one area that’s seeing direct impacts is the healthcare industry. Not only are millions turning to their healthcare providers for help addressing COVID-19, but they’re also doing so in new ways as a result of the pandemic. Stay-at-home orders and concerns over exposure at hospitals have led to an explosion in the use of telehealth and digital health services.

This isn’t all new, of course. It’s been a long time since the stereotype of the lone country doctor doing house calls has been even close to true, and the industry has been evolving and growing ever since its earliest stages prior to the Civil War. In those days, medical care was a luxury with hospitals located in a few major cities to serve patients but little else available. The first hospital in the U.S., the Royal Hospital in New Orleans, opened in 1722 as a military facility but was later switched over for civilian use. By that point it was too expensive for the majority of the residents in the area to visit, so a second, charity-based hospital was built nearby, starting the tradition of hospitals serving all as a type of public service.

Medical innovation accelerated dramatically in the 20th century, with the advent of new technologies like X-ray and Magnetic Resonance Imaging improving doctor’s diagnostic capabilities, the expansion of vaccines helping to protect public health from infectious diseases, to new surgical anesthetics, antibiotics, heart surgeries, radiologic imaging and more.

As ABC News explained in 2007: “Whether it’s the technology that allows us to peer deep into the body or medicines that extend the lives of those with chronic diseases, it’s easy to see how advances in health and medicine have touched the lives of nearly every person on the planet. Yet considering the ubiquitous nature of these developments, it is easy to see how many people take for granted the technologies and practices that, at one point or another, almost certainly saved their own lives or the lives of people they’ve loved.”

The history of healthcare is a history of innovation.

That’s one of the reasons that it has become such a popular segment for investors looking to generate gains while also supporting work that’s protecting the health of millions of people. But, for those interested in the investment potential of this booming market, there are a few important points to understand.

What Is Included in ‘Healthcare’?

According to Webster’s dictionary, “healthcare” includes any “efforts made to maintain or restore physical, mental, or emotional well-being especially by trained and licensed professionals.” This includes everything related to maintaining or improving a person’s health, including the prevention, diagnosis, treatment, recovery or cure of diseases, injuries and any other physical problems that they might be experiencing.

And the list of other professionals involved in delivering healthcare is equally long, including doctors, nurses, surgeons, pharmacists, dentists, optometrists, psychologists, therapists, athletic trainers and more. Anyone providing care to people – including on the scale of public health – is involved in healthcare.

Here in the U.S., the term “healthcare” also typically applies to the entire healthcare delivery system, ranging from individual doctor’s offices all the way up to hospitals and pharmaceutical companies. A health system is a network of related facilities – usually three to 10 hospitals – that work together to deliver health services to patients in their geographic area. The National Bureau of Economic Research defines health systems based on three types of arrangements: (1) organizations with common ownership, (2) those that are contractually integrated, and (3) those that are part of informal care systems, such as common referral arrangements. “Systems include organizations combined horizontally (e.g., a hospital system) or vertically (e.g., a multihospital system also owning physician practices and post-acute care facilities).”

These systems are typically major employers in their communities and are effectively one-stop-shops for all of their patient’s healthcare needs.

Of course, delivery is just part of the healthcare equation. It also has to be paid for, and that’s where the health insurance side of things comes into the picture. Health insurance today is a tangled web of private plans, employer-provided plans, government-backed programs like Medicare and Medicaid and more. Add to this the Affordable Care Act, introduced in 2010, intended to overcome some of the limitations of the private, for-profit health insurance industry and expand affordable coverage to all Americans.

Why Invest in Healthcare?

As an industry, healthcare is massive.

Worldwide, the industry was worth $8.45 trillion as of 2018 and accounts for about 10% of most GDPs. This is on track to exceed $10 trillion by 2022.

In the U.S., it’s even bigger. As of 2019, healthcare accounted for nearly 18% of U.S. GDP and is the country’s largest employment sector, employing 1 out of every 8 Americans. We also spend the most on our health individually, at more than $10,000 annually per capita.

It’s also an extremely lucrative segment of the economy. Among the 784,000-plus companies in U.S. healthcare, more than $1 trillion in annual revenue comes from patient services, with $74 billion coming from rehab services, $50 billion from dental services and more than $44 billion from government grants and contributions. Healthcare deals with a lot of big numbers.

But there are hopes that new technologies can help tame this system and unlock new efficiencies. According to some estimates, the internet of things (IoT) can lower the costs of operational and clinical inefficiencies by $100 billion per year, and 64% of physicians believe it can help reduce the burden on nurses and doctors.

Beyond IoT, healthcare is finding new applications for Artificial Intelligence in managing patient care, blockchain in handling patient health records, chatbots for customer service and virtual reality for physician training. That’s to say nothing of the potential for marketing automation, supply chain logistics and other proven technologies that are finally finding applications in the healthcare space.

How to Invest in Healthcare

Naturally, healthcare is a large and sprawling industry. For investors, it can be challenging to choose where to invest in a segment that includes everything from drug development, to medical devices, to home health services and much more.

Investing in a mutual fund or ETF that offers exposure to the entire healthcare world is a good way to overcome this limitation, and a search on Magnifi suggests that there are a number of such funds for investors to choose from.

Unlock a World of Investing with a Magnifi Account

Magnifi is changing the way we shop for investments, with the world’s first semantic search engine for finance that helps users discover, compare and buy investment products such as ETFs, mutual funds and stocks. Open a Magnifi investment account today.

The information and data are as of the June 3, 2020 (publish date) unless otherwise noted and subject to change. This blog is sponsored by Magnifi.

Vegan

From coconut coffee creamers and dairy-free yogurt to veggie burgers, the market for plant-based, natural foods and beverages are outpacing total food and beverage sales overall.

According to SPINS’ 2019 State of the Natural Industry, the market for natural food and beverage products is growing at 5.0% compared to that of total food and beverages growing at 1.7% year-over-year.

While the growth is astounding, it’s not necessarily surprising.

If you’ve been to the grocery store recently, you know that plant-based products are no longer limited to one aisle and aren’t marketed to just one specific type of consumer. Plant-based products are everywhere and stores are asking all shoppers to try them.

In other words, you don’t have to be a strict vegan to buy the latest brand of oat milk or plant butter.

And, more and more consumers are trying the plant-based versions of more traditional products, knowingly or unknowingly adopting a flexible vegetarian status known “flexitarian.”

The term flexitarian was coined in 2009 by registered dietitian Dawn Jackson Blatner who promoted eating more plants and less meat overall, or rather, being vegetarian most of the time. The diet is geared to promote overall health while not totally depriving followers of animal-based products.

Because of the lax guidelines that allow for mostly eating more veggies that the diet promotes, consumers are increasingly adopting it in one form or another—and eating more vegan products than ever.

Consider the success story of Beyond Meat, the plant-based burger company whose stocks skyrocketed after going public in May 2019, up 213% by November. According to UBS investment, Beyond Meat’s sales could reach $1.8 billion by 2025.

Who is buying Beyond Meat’s plant-based burgers? It’s not just vegans, but meat eaters, too.

As the number of vegans (including those with part-time buy-in) is on the rise, so is the unprecedented demand for plant-based products in grocery stores, restaurants, and beyond.

What Is Veganism?

Vegetarian diets typically eliminate meat and fish but allow for the consumption of eggs and dairy. Veganism is much more restrictive, eliminating all items of animal origin, including any food made with animal flesh, dairy products, eggs, or honey. The authentic Vegan lifestyle goes further, extending beyond food consumption to everything from textiles to clothing and cosmetics.

Generally, veganism offers three primary features: (1) additional curtailment of animal mistreatment and slaughter, (2) reduction of certain health risks, and (3) decrease of environmental footprint.

That’s right, it’s good for the environment.

Beyond being healthy for our bodies, veganism is promoted as a tool to combat climate change. Raising meat requires a massive use of grain and water. After slaughter, farmed animals are processed, transported, and stored, requiring the consumption of even more energy. Plant-based options tend to be more environmentally friendly.

The number of people choosing to live a vegan lifestyle worldwide is on the rise. In the United States, the demographic has grown by 600 percent between 2014 and 2018, from 4 million to 20 million people. The vegan population in the UK similarly quadrupled between 2014 and 2018.

This growth of veganism in conjunction with non- or sometimes-vegan consumers who buy plant-based foods for health and environmental reasons means a fast-growing market and more investment opportunities than ever.

Why Invest in Veganism?

Vegan products are a $7.1 billion market, growing at a rate of 10.1%. The plant-based meat market alone is anticipated to be valued at $27.9 billion by 2025 globally.

The market for other plant-based dairy alternatives, like cheese and milk, are also growing at unprecedented rates. Milk alternatives include soy milk, almond milk, rice milk, oat milk, coconut milk, and flaxseed milk. According to a recent study, the global dairy alternatives market is expected to grow, reaching $26.86 billion by 2023.

Alternatives to traditional butter exist as well. The US plant-based butter industry is valued at $198 million and growing. Between 2017 and 2019, sales of plant-based butter increased 15%, growing faster than the sales of traditional butter.

And these trends are going mainstream. In addition to niche plant-based butter brands like Milkadamia and Miyoko, Country Crock debuted its “Plant Butter” made with olive oil, avocado oil, and almond oil in September 2019. Non-dairy yogurts made with almonds, cashews, or coconut are also on the rise.

This phenomenon isn’t just on grocery store shelves, but in restaurants, too. White Castle offers the Impossible Sliders, Burger King offers the Impossible Whopper, and Carl’s Jr.’s offers the charbroiled Beyond Famous Star.

And, Wall Street is taking notice the sales of plant-based products. Beyond Investing introduced the US Vegan Climate ETF, listed on the New York Stock Exchange under the ticker VEGN, in fall 2019. The ETF excludes oil-related stocks as well as meat-centric companies.

Vegans are passionate about the environment and their health. And, no matter what degree of vegan one is, they are willing to pay the cash for the burger that’s just as good or maybe even better than the meat alternative.

In other words, plant-based products are here to stay, and varieties and consumer buy-in are sure to grow.

How to Invest in Veganism

But getting involved in a market segment as large and diverse as veganism — which impacts everything from food & beverage, to personal care, clothing and more — isn’t as straightforward as it sounds. But, by investing in mutual funds and ETFs that offer exposure to veganism as a whole, investors can spread their impact out to all of the companies that are working in this sector. A search on Magnifi suggests there are a number of ways for investors to get involved in veganism this way.

Unlock a World of Investing with a Magnifi Investment Account

Magnifi is changing the way we shop for investments, with the world’s first semantic search engine for finance that helps users discover, compare and buy investment products such as ETFs, mutual funds and stocks. Open a Magnifi investment account today.

This blog is sponsored by Magnifi. The information and data are as of the June 2, 2020 (publish date) unless otherwise noted and subject to change.