Wearables

Unlock a World of Investing with a Magnifi Account

How many steps have you gotten today? For many of us, that question might cause us to automatically glance at our wrists.

Smart watches, fitness trackers, high-tech clothing, glasses, and more— wearables have gone from a futuristic idea for health and wellness to the new normal.

While the big names including FitBit, Apple Watch, and Samsung lead the way, they aren’t the only players in the market.

WHOOP, for example, is a Boston-based digital fitness company that closed a $100 million Series E financing round in late October. Whoop, a sponsor of many athletes across sports, is designed to help athletes determine whether they need to rest or push themselves. The company is now valued at $1.2 billion, giving it unicorn status.

From sleep monitoring to calorie tracking and beyond, more and more people are opting to wear devices that collect health data and metrics and connect to each other.

These devices are advancing fast from simply counting steps. Apple’s Apple Watch, for example, enables users to perform an electrocardiogram heart reading. Matrix PowerWatch Series 2 can charge itself from solar power or body heat, instead of electricity.

Here’s what investors need to know about the current state of the wearable market and what its potential looks like.

What Are Wearables?

While wearables might seem new, they aren’t even a 21st century idea.

It’s thought that Leonardo da Vinci developed the first pedometer in the 15th century as a means to track the distance a soldier walked. Later, in the 18th century, Thomas Jefferson created the first pedometer in the US and introduced it to the American public. Beyond pedometers, most believe that a tiny abacus worn as a ring in the 17th century in China is the world’s oldest smartwatch of sorts.

These days, modern wearable technology quantifies human movement and records physiological metrics. Diagnostic wearable medical devices “monitor, control, and track an individual’s vital signs at regular intervals.” Different wearables measure different physiological information, including blood pressure, body temperature, respiratory rate, glucose quantity, heart rate, blood oxygen saturation, heart rate, muscle activity, or calories burned during exercise. These devices typically work autonomously and come in a variety of forms.

When did wearables get so popular, again? FitBit launched its first device in 2009, a wireless device that clipped onto clothing. The first model wasn’t smartphone connected. And while 2012 models linked directly to smartphones, it wasn’t until 2013 that FitBit released a wrist worn tracker. In 2015, FitBit sold 21.4 million devices and in 2016, it sold 22.3 million devices.

That’s not to mention smartwatches, which are technically wearable computers. Apple, Samsung, and FitBit dominate the smartwatch market today, which is anticipated to reach a market value of $130.55 billion by 2024 from $48.14 billion in 2018, indicating significant growth.

Wearables are getting smarter and smaller. Smart jewelry, as of 2020, includes the smart ring by OURA. A company named Joule is even working on a smart earing backing. Larger pieces have advantages, however. Smart clothing, for example, covers a larger area of the body and so can detect even more information. For example, Samsung has a patent for a shirt that can detect breathing issues and lung disease.

Another type of wearable, called “hearables,” is on the rise too.

According to Scotland’s National Health Service (NHS), “devices that are primarily intended to allow streaming of media to the device but that also offer a hearing enhancing function not dissimilar to a hearing aid.” The hearables market is estimated to grow to a $93 billion dollar market by 2026.

But wearables aren’t just… worn.

For instance, the first ingestible digital health feedback system, developed by Proteus Digital Health, was approved by the FDA in 2012. Wearables come in many shapes and sizes, and have an increasing number of uses and potential uses (and users).

Why Invest in Wearables?

In a world dealing with obesity and other chronic health conditions, wearables have the potential to shift medicine from the intervention stage to prevention.

According to the Centers for Disease Control and Prevention (CDC), 6 in 10 adults in the US have a chronic disease, such as heart disease, cancer, chronic lung disease, stroke, Alzheimer’s disease, diabetes, or chronic kidney disease. Lifestyle choices that influence chronic disease include tobacco use, poor nutrition, lack of physical activity, and excessive alcohol use.

That’s where wearables come in. By tracking personal habits, the user is able to make changes before things get out of hand.

While wearables are wildly popular, they have yet to tap the potential in the world of remote medicine. In fact, although remote monitoring tools have enormous potential for patients with chronic illnesses, they remain vastly underused. Case in point: “ninety-one percent of the patients who use wearables identify as an athlete, compared to the only 21 percent who said they have a chronic illness.” Nonetheless, wearable technology is a promising tool in the fight against chronic disease.

Wearables offer a myriad of potential health solutions, from monitoring key health indicators to minimizing touch on shared surfaces. Wearables can open doors in office buildings, for example. Wearables can also monitor and flag changes in body temperature. Over time, wearables can determine trends and track performance, offering increasingly personalized feedback and training opportunities.

Increased adoption of wearable devices and market potential in medicine make wearables a worthy investment.

FitBit has close to 500,000 subscribers to FitBit Premium, with the pandemic strengthening business as consumers seek ways to stay healthier from home. As part of its growth plan, FitBit plans to continue to promote subscriptions that foster engagement, as well as develop telemedicine potential. For example, the company may promote add-on devices such as a connected thermometer or an otoscope that can lessen the need for in-person doctor visits. It’s also conducting research to determine how effective the technology can be in detecting COVID-19 early.

Apple also has its eye on health, specifically monitoring key indicators in senior citizens.

The wearable market isn’t expected to slow down anytime soon. While wearables have shown significant growth thus far, they have loads of potential, especially as it relates to increasing integration with healthcare in a world riddled with chronic disease and reeling from a pandemic.

Unlock a World of Investing with a Magnifi Account

Magnifi is changing the way we shop for investments, with the world’s first semantic search engine for finance that helps users discover, compare and buy investment products such as ETFs, mutual funds and stocks. Open a Magnifi investment account today.

The information and data are as of the November 17, 2020 (publish date) unless otherwise noted and subject to change. This blog is sponsored by Magnifi.

Fiduciary Risk and Magnifi’s New Fi360 Scoring

Advisors know that private wealth management is an increasingly competitive market. And while all advisors in the field should act as responsible fiduciaries by minimizing fiduciary risk, not all do.

As an advisor, this leaves you with two challenges. First, minimizing fiduciary risk in all portfolios, and second, demonstrating this minimized risk to clients and prospective clients. While that might sound daunting, with the right technology, it’s entirely possible.

Read more

Magnifi Names Broadridge Executive as Chief Product Officer

Investment in talent comes on the heels of stellar market adoption since launch earlier this year

BOULDER, Colo., November 17th, 2020 - Magnifi, a TIFIN Group company, and the world's first natural-language powered investment marketplace today announced the appointment of Broadridge Financial veteran, Tom Van Horn, to serve as the company's first Chief Product Officer. Tom brings deep experience from leading various technology and innovation roles within the financial services industry and will lead the evolution of Magnifi’s platform through its next stage of growth.

On-trend with tenured executives departing financial services and technology incumbents to lead innovative FinTech start-ups, Tom’s arrival at Magnifi coincides with high-velocity market adoption. As of November 1st, 2020, Magnifi’s retail and professional users influence over $320B in Assets with over 150K users actively searching for investments on Magnifi. Founded by Dr. Vinay Nair, Chairman of The TIFIN group and a serial FinTech entrepreneur, Magnifi launched early in 2020 and has since been featured on national broadcast and financial trade media. Andrew Ross Sorkin of CNBC Squawk Box called Magnifi “The Google for Investments: The start-up changing the way investors access investment ideas.”

“Magnifi is unlike anything I have seen in the wealth and asset management industry during my career in FinTech,” said Van Horn. “With its foundational elements of patented natural language recognition and robust investment intelligence, the platform breaks down the opaqueness of investment products and makes them more accessible for individual and professional investors. I could not be more energized to engrain myself with such a talented group of professionals changing the investment marketplace as we know it.”

Van Horn brings almost 20 years of experience across different product, technology, and executive roles to Magnifi. He was most recently Vice President of Product Management at Broadridge Financial where he led product growth, innovation, and execution for Broadridge’s wealth management segment. In this role, Tom has built a track record of innovation and product execution across the largest North American wealth management firms and Broker-Dealers ranging from front to back-office wealth management solutions. Prior to his role with Broadridge Tom was Senior Vice President of Operations with leading portfolio management company FinFolio and Chief Compliance Officer/Director of Operations for a leading wealth management RIA firm in Denver, Colorado.

“We are delighted to have Tom join Magnifi’s leadership team. When top industry talent like Tom decides to come on board, it is a wonderful validation of our traction and potential ” said Rick Hurwitz, Chief Executive Officer of Magnifi. "With Tom’s deep industry roots and track record of shaping successful products, we are well-positioned to enhance the Magnifi platform to best serve our clients.”

About Magnifi

Magnifi is a financial search platform that is changing the way people shop for investments. The world's first semantic search engine for finance, the platform helps financial advisors, portfolio managers, and everyday investors find, compare, and act on investment options. In an era with thousands of ETFs, mutual funds, stocks, and model portfolios to choose from, Magnifi demystifies and simplifies investing, providing insights and information that save time and help investors make smarter decisions. Learn more at www.magnifi.com

About the TIFIN Group

The TIFIN Group is a FinTech studio that starts and operates companies focused on shaping the future of investor experience to create better outcomes for investors. TIFIN companies combine the power of modern technology, investment science, and behavioral design to advance themes of interest to investment managers, advisors, and investors.

For media inquiries, please contact:

Niharika Shah

Chief Marketing Officer

The TIFIN Group

[email protected]

Nanotechnology

The term nanotechnology might seem like something reserved for a science lab, but it is as close as the latest pregnancy announcement that you may have heard.

That’s right, the second pink line on a pregnancy test only appears if the hCG hormone is present. If the tester is pregnant, gold nanoparticles tagged with a specific antibody attach to the hCG on the second strip.

And nanotechnology is doing more than telling women they are pregnant. Advances are improving bulletproof vests, making plastic beer bottles possible, and coating products to make them better— from flame resistant furniture to fortified glass surfaces to antimicrobial bandages.

The global nanotechnology market is projected to reach $2.23 billon by 2025 according to a study by Allied Market Research. This growth is credited to increasing applications across industries, including communication, medicine, transportation, agriculture, energy, materials and manufacturing, and consumer products.

What is Nanotechnology?

A nanometer is the microscopic measurement of one billionth of a meter. For perspective, consider that one sheet of paper is roughly 100,000 nanometers thick.

According to the National Nanotechnology Initiative, nanotechnology is, “the study and application of extremely small things and can be used across all the other science fields, such as chemistry, biology, physics, materials science, and engineering.” In other words, it’s the ability to manipulate and create matter, enhancing it for the purpose it will serve, at the molecular level.

Why Invest in Nanotechnology?

Nanotechnology is an exciting investment opportunity because of its growing, impactful applications across industries.

Nanotech innovation and their applications have a range of biomedical potential. In medicine, specifically, nanotechnology is solving real-world health challenges by innovating from prevention to diagnostics to treatment.

For example, antibiotics have long been a standard treatment for infection. However, the overuse of antibiotics has resulted in increasingly drug-resistant bacteria. According to the Centers for Disease Control and Prevention (CDC), there were an estimated 119,247 cases of drug-resistant Staphylococcus aureus bloodstream infections and 19,832 associated deaths nationwide in 2017.

As an alternative to antibiotics, novel nanomaterials can combat pathogens, not only offering a more targeted delivery of medicine and therapeutics, but also a more targeted treatment.

The potential for nano-driven solutions to public health issues is not lost on big investors.

Novo Holdings REPAIR Impact Fund, recently invested EUR 7 million in Mutabilis, a company developing novel antibacterials for drug-resistant bacteria.

And nanovaccines against both bacteria and cancerous tumors are also in the works, according to a recent report from the Advanced Materials “Biomimetic Nanotechnology toward Personalized Vaccines.” Not only can nanotechnology “increase the potency of vaccines,” it can personalize applications of both vaccines and treatments with the potential for tremendous social and economic impact.

Nanotechnology is also helping patients suffering from endometriosis, a condition that affects 10% of childbearing-age women.

The traditional treatment for the condition was to surgically remove lesions, which often recur after surgery and require multiple invasive surgeries. Using nanotechnology, scientists instead employ tiny polymeric materials packed with a specialized dye. The tiny materials fluoresce to show where the lesions are (essentially providing imaging) and then kill the lesion cells by flaring to 115 degrees Fahrenheit upon exposure to near-infrared light, helping to remove the lesions.

Nanotechnology is also improving cardiovascular care by reducing the size and improving the effectiveness of instruments used for cardiac surgery.

There’s even the potential for nanorobots to operate within the human body, analyzing and reporting on specific tissues.

Nanotech also has broad potential beyond the healthcare field.

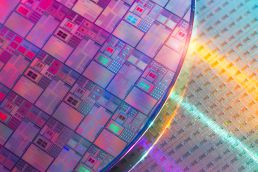

Nanotechnology is constantly improving electronics, which, as they become smaller and smaller, also become increasingly harder to manufacture. Nanotech can shrink these technology tools so that they fit in our pockets while also making them better at processing data, increasing memory space, making wearable tech lighter and more portable, and improving functionality overall.

Nanotechnology is also responsible for the lithium-ion battery. Offering a minimum power draw and high-energy-density, these now commonplace batteries weren’t on the market until the 1990s. Since then, they’ve become increasingly more powerful and less expensive.

And yet, the innovation hasn’t stopped. The world is now taking stock of graphene, a single, thin layer of graphite. Although graphene shares the same atoms as graphite, its properties are extremely different because the atoms are arranged differently.

Nanotech Energy, a battery and graphene technology startup, recently secured $27.5 million in funding, according to the company. Founded in 2014, the company plans to release a non-flammable, environmentally friendly lithium battery that charges much quicker than those currently on the market in the coming year.

How to Invest in Nanotechnology

The growth potential for nanotechnology is impressive, but the sector doesn’t come without risk. Although nanotech has been around for years, it is still considered an emerging field and the industry is still sorting out where the best, most profitable applications lie. This can make investing in individual nanotechnology companies a risky proposition.

However, a search on Magnifi indicates that there are a number of ETFs and mutual funds available to give investors broad exposure to this industry without concentrating their bets on any one company.

Unlock a World of Investing with a Magnifi Account

Magnifi is changing the way we shop for investments, with the world’s first semantic search engine for finance that helps users discover, compare and buy investment products such as ETFs, mutual funds and stocks. Open a Magnifi investment account today.

The information and data are as of the June 8, 2021 (publish date) unless otherwise noted and subject to change. This blog is sponsored by Magnifi.

Drones

Unlock a World of Investing with a Magnifi Account

Pick a beach, park or other open area, and you might get the impression that flying drones seem to have replaced flying kites. While this is partly true, the depth and breadth of the applications of drone technology go far beyond recreation to an advancing and growing market of military and commercial uses.

From agriculture and environmental monitoring, to law enforcement and delivery services, drones are improving and expanding the efficiency and accuracy of research and commercial projects around the world in a myriad of ways.

More and more, companies are realizing this and investing in new drone technologies. According to the Federal Aviation Administration’s 2019 Aerospace Forecast, the FAA expects the commercial drone market to triple by 2023. According to a market report published in September 2020, the global Commercial Drone market size is projected to reach $34 billion by 2026, a considerable jump from the $6 billion it racked up in 2020.

Here’s what investors should know about drone technology and their market potential.

What Are Drones?

Drones, the more common name for Unmanned Aerial Vehicles (UAVs), are unpiloted aircraft or spacecraft. They vary in shape, size, and use. For example, some drones require a human operator, but some do not. Some drones are so small they can fit in your hand, while some are as large as traditional aircraft.

There are three standard types of drones, including Single Rotor Helicopters, Multi-Rotor Drones, and Fixed Wing Drones. Single Rotor Helicopters look like small helicopters, and they are often used to transport heavy objects, survey land, and gather data. Multi-Rotor Drones are small and often used for photography or hobby-flying. Fixed-wing drones look like normal airplanes and run on fuel rather than electricity, allowing them to run for much longer.

While drone applicability is expanding in the modern world in tandem with advancing drone technology, the notion of utilizing unpiloted aircraft isn’t a new one. Drones were first used in the mid-1800s when in 1849, Austria launched a balloon bomb attack on Venice. By WWII, technology had advanced to models like Austrian Jindivik, a pilotless target aircraft.

It’s not surprising that drone technology has been advanced by militaries around the world for many years. This is in part because drones offer a range of military uses, from reconnaissance that doesn’t necessitate putting a pilot’s life at risk to offensive strikes in hard-to-reach areas. Drones also don’t require rest like their human counterparts, just enough fuel or battery power to fulfill their mission.

Drones are also playing an important role in advancing our knowledge of space. NASA’s Dragonfly mission will use a drone to sample and examine sites around Saturn’s icy moon beginning in 2026. This will be the second outer space drone mission, following the launch of a small helicopter scout as part of NASA’s Mars 2020 rover mission, expected to land in February 2021.These advanced outer space missions are not to mention that in 2019, X-37B an astronaut-free spacecraft that has clocked as many as 719 days in continuous low-earth orbit. X-37B is a reusable spacecraft that has taken five missions since 2010.

Somewhat surprisingly, it wasn’t until 2006 that non-military, commercial applications of drones began. Then, suddenly, their uses expanded to functions from pipeline inspections to crop evaluation to security and beyond.

Why Invest in Drones?

In the modern world, the application of drones is exploding. And, it’s playing a role in not only the advancement of science and industry, but also real-world geopolitics.

In the ongoing conflict between Azerbaijan and Armenia over the region of Nagorno-Karabakh, for example, drones are a contentious weapon. In early October 2020, Canada boldly “suspended the sale of advanced drone optics to Turkey over allegations that the technology is being used in the conflict” to support Azerbaijan. At the end of October 2020, Armenia called for more Western nations to do the same.

In Malaysia, the state of Selangor is planning drones to patrol waterways for polluters day and night, a prevalent issue that plagues the country.

In China, the use of agricultural drones has seen a dramatic uptick, improving farming efficiency. Chinese agricultural drones can cover more than 50 to 60 times the amount of farmland that more traditional manual farm work can.

In the U.S. poultry industry, drones and robots are expected to play an increasing role in more efficient production. For example, drones can be used to spot dead birds, or even monitor the gait of birds to detect illness. Likewise, drones have the potential to administer aerosol vaccines. These applications are particularly promising considering that producers can purchase quality drones starting at only $500.

And let’s not forget about the drone delivery of online purchases we’ve all been waiting for.

In September 2020, Amazon.com Inc. received approval from the Federal Aviation Administration to “establish a fleet of drones” and begin testing drone deliveries. It follows companies including Uber Technologies Inc., Wing (of Google’s parent company Alphabet), and UPS. This is a long-awaited step forward after Amazon’s first announcement that it would pursue drones for delivery in 2013.

Behind all these advances (and many more) there are numerous companies developing, manufacturing, and selling this in-demand technology. So, while the hobby-drones that we see at the park are indeed a multi-billion-dollar industry, they are the tip of an iceberg of opportunity for investors with an eye towards the future.

How to Invest in Drones

From military and defense applications, to surveying and data collection, drones are everywhere these days. That can make it challenging for investors who want to get into the space; there are just so many options out there to consider.

However, there are a number of mutual funds and ETFs that give investors access to the drone industry without having to focus on any particular companies. A search on Magnifi suggests that investors have a number of choices in this fast-growing industry.

Unlock a World of Investing

with a Magnifi Account

Magnifi is changing the way we shop for investments, with the world’s first semantic search engine for finance that helps users discover, compare and buy investment products such as ETFs, mutual funds and stocks. Open a Magnifi investment account today.

The information and data are as of the November 11, 2020 (publish date) unless otherwise noted and subject to change. This blog is sponsored by Magnifi.

Build Client Portfolios the Easy Way

Great news… your firm has landed new clients and is growing fast. The papers are signed, the money is in place, and now, all that you need to do is seamlessly deliver flawless, individualized portfolios for each of them that can weather the current tumultuous economy. No problem, right? If you have the right technology, it’s no problem at all.

Read more