Insurance Technology

Unlock a World of Investing with a Magnifi Account

Insurance companies often face fierce competition with each other for many of the same customers. In the U.S., the car insurance market, for example, is dominated by a handful of major players. The 10 largest companies in the industry control approximately 72% of the market, according to Value Penguin by Lending Tree.

The winners and losers of each year are determined by which companies pick up more market share. In 2019, Progressive notably gained more than a percentage point of the market share in the auto insurance industry.

Insurance, however competitive, is an industry that seems entrenched in archaic processes.

This might not be the case for long, though – the insurance industry is expected to change dramatically in the next five to ten years, according to McKinsey. The firm expects the industry to shift as customer expectations and technology rapidly evolve.

Insurance technology i.e. insurtech, or the innovative use of technology in the insurance industry, seeks to bring greater value to customers and companies. And it’s not going unnoticed. According to PricewaterhouseCoopers, “insurtech has become a powerful driver of change in the insurance industry.”

In fact, the number one risk facing the global insurance industry is technology modernization, according to PwC. To remain competitive, companies need to keep their tech improving and their processes modernizing.

What Is Insurance Technology?

Insurtech “is a term used to refer to technology designed to enhance the operations of insurance firms and the insurance industry as a whole.” Insurance technologies include big data, artificial intelligence, consumer wearables, and smartphone apps, which are ushering out the old processes of insurance for new ones.

These new technologies are extremely valuable to insurance companies; insurtech companies offer pay-per-use and an emphasis on loss prevention and restorative services, according to PwC.

According to Duck Creek Technologies, there are 8 top technology trends in insurance.

Predictive analytics: Predictive analytics analyzes data to make predictions about the future. In insurance, technology is most used for: (1) pricing and product optimization; (2) claims prediction and timely resolution; (3) behavioral intelligence and analytics to predict new customer risk and fraud; (4) uncovering agent fraud and policy manipulation; (5) optimizing user experience through dynamic engagement, and (6) big data analysis.

Artificial Intelligence (AI): In the insurance industry, like in many industries, artificial intelligence is helping companies to personalize experiences and make business processes more accurate and expedited.

Machine learning: Machine learning is the ability of a program to learn through a variety of algorithms. Machine learning is helping to improve and even automate the claims process by utilizing pre-programmed analysis.

Internet of Things (IoT): Sharing data from smart devices can save customers money on policies. In 2019, 34.8 million homes in the U.S. were considered smart homes. Because smart home features increase safety and decrease energy usage, insurance companies can use them to better assess risk and reduce costs for consumers.

Data: In the insurance industry, social media is more than a tool for marketing. Not only can social media analytics be used to increase sales, it can also be used to improve loss ratios.

Telematics: Do you plug a device that monitors your car’s use and speed to get a better price? Telematics are like a “a wearable device for your car.” Telematics are thought to help both insurance companies and insurance customers by encouraging better driving habits, lowering claims costs for insurance, and making carrier to customer relationships more proactive than reactive.

Chatbots: Chatbots are a growing phenomenon. Insurance companies can use bots to help customers apply for insurance or file a claim, freeing up employees to help with more complicated needs. For example, Geico offers Kate, a virtual assistant that can quickly help customers with information like the current balance on an auto insurance policy, the date of a next payment, or by providing access to policy documents 24/7.

Drones: While it might be easier to imagine drones dropping off packages for customers than administering insurance, drones are gaining a role in insurance. For example, how does a virtual visit to assess risk or damage sound in the COVID-19 pandemic? That’s what programs like the Remote Visit application offered by FM Global are doing. Another example, Farmers’ Kespry drone program, was launched in 2017 to review roof damage following weather events, leading to faster assessment turnaround and increased safety for claims reviewers.

Why Invest in Insurance Technology?

The insurance industry is ripe for innovations of all kinds.

According to PwC, Global insurance technology investments in 2018 totaled $4.15 billion. 2020 expedited the adoption of technology in the insurance industry. This is no surprise considering that insurtech facilitates things like virtual sales, virtual claims interactions and expense reduction, according to Deloitte.

Despite the pandemic-induced economic uncertainty, “insurtech industry investments in the aggregate appear to be as robust as ever,” according to Deloitte. $2.2 billion in investments in insurtech were recorded in the first half of 2020 alone.

It’s not just disruptors to the industry to be on the lookout for. Legacy carriers that successfully adopt technology internally will also benefit in the long term.

According to Sam Friedman, insurance research leader at the Deloitte Center for Financial Services in an interview with Insurance Business America: “I don’t see a behemoth insurtech out there that’s going to essentially end the insurance business as we know it, and take over massive amounts of market share….Where insurtech is having a huge impact is in helping insurers become better at what they do.”

Unlock a World of Investing with a Magnifi Account

Magnifi is changing the way we shop for investments, with the world’s first semantic search engine for finance that helps users discover, compare and buy investment products such as ETFs, mutual funds and stocks. Open a Magnifi investment account today.

The information and data are as of the January 4, 2021 (publish date) unless otherwise noted and subject to change. This blog is sponsored by Magnifi. This material is provided for informational purposes only and should not be construed as individualized investment advice or an offer or solicitation to buy or sell securities tailored to your needs. This information covers investment and market activity, industry or sector trends, or other broad-based economic or market conditions and should not be construed as investment research or advice. Investors are urged to consult with their financial advisors before buying or selling any securities. Although certain information has been obtained from sources believed to be reliable, we do not guarantee its accuracy, completeness or fairness. Past performance is no guarantee of future results. This content may not be reproduced or distributed to any person in whole or in part without the prior written consent of Magnifi. As a technology company, Magnifi provides access to tools and will be compensated for providing such access. Magnifi does not provide broker-dealer or custodial services.

Wearables

Unlock a World of Investing with a Magnifi Account

How many steps have you gotten today? For many of us, that question might cause us to automatically glance at our wrists.

Smart watches, fitness trackers, high-tech clothing, glasses, and more— wearables have gone from a futuristic idea for health and wellness to the new normal.

While the big names including FitBit, Apple Watch, and Samsung lead the way, they aren’t the only players in the market.

WHOOP, for example, is a Boston-based digital fitness company that closed a $100 million Series E financing round in late October. Whoop, a sponsor of many athletes across sports, is designed to help athletes determine whether they need to rest or push themselves. The company is now valued at $1.2 billion, giving it unicorn status.

From sleep monitoring to calorie tracking and beyond, more and more people are opting to wear devices that collect health data and metrics and connect to each other.

These devices are advancing fast from simply counting steps. Apple’s Apple Watch, for example, enables users to perform an electrocardiogram heart reading. Matrix PowerWatch Series 2 can charge itself from solar power or body heat, instead of electricity.

Here’s what investors need to know about the current state of the wearable market and what its potential looks like.

What Are Wearables?

While wearables might seem new, they aren’t even a 21st century idea.

It’s thought that Leonardo da Vinci developed the first pedometer in the 15th century as a means to track the distance a soldier walked. Later, in the 18th century, Thomas Jefferson created the first pedometer in the US and introduced it to the American public. Beyond pedometers, most believe that a tiny abacus worn as a ring in the 17th century in China is the world’s oldest smartwatch of sorts.

These days, modern wearable technology quantifies human movement and records physiological metrics. Diagnostic wearable medical devices “monitor, control, and track an individual’s vital signs at regular intervals.” Different wearables measure different physiological information, including blood pressure, body temperature, respiratory rate, glucose quantity, heart rate, blood oxygen saturation, heart rate, muscle activity, or calories burned during exercise. These devices typically work autonomously and come in a variety of forms.

When did wearables get so popular, again? FitBit launched its first device in 2009, a wireless device that clipped onto clothing. The first model wasn’t smartphone connected. And while 2012 models linked directly to smartphones, it wasn’t until 2013 that FitBit released a wrist worn tracker. In 2015, FitBit sold 21.4 million devices and in 2016, it sold 22.3 million devices.

That’s not to mention smartwatches, which are technically wearable computers. Apple, Samsung, and FitBit dominate the smartwatch market today, which is anticipated to reach a market value of $130.55 billion by 2024 from $48.14 billion in 2018, indicating significant growth.

Wearables are getting smarter and smaller. Smart jewelry, as of 2020, includes the smart ring by OURA. A company named Joule is even working on a smart earing backing. Larger pieces have advantages, however. Smart clothing, for example, covers a larger area of the body and so can detect even more information. For example, Samsung has a patent for a shirt that can detect breathing issues and lung disease.

Another type of wearable, called “hearables,” is on the rise too.

According to Scotland’s National Health Service (NHS), “devices that are primarily intended to allow streaming of media to the device but that also offer a hearing enhancing function not dissimilar to a hearing aid.” The hearables market is estimated to grow to a $93 billion dollar market by 2026.

But wearables aren’t just… worn.

For instance, the first ingestible digital health feedback system, developed by Proteus Digital Health, was approved by the FDA in 2012. Wearables come in many shapes and sizes, and have an increasing number of uses and potential uses (and users).

Why Invest in Wearables?

In a world dealing with obesity and other chronic health conditions, wearables have the potential to shift medicine from the intervention stage to prevention.

According to the Centers for Disease Control and Prevention (CDC), 6 in 10 adults in the US have a chronic disease, such as heart disease, cancer, chronic lung disease, stroke, Alzheimer’s disease, diabetes, or chronic kidney disease. Lifestyle choices that influence chronic disease include tobacco use, poor nutrition, lack of physical activity, and excessive alcohol use.

That’s where wearables come in. By tracking personal habits, the user is able to make changes before things get out of hand.

While wearables are wildly popular, they have yet to tap the potential in the world of remote medicine. In fact, although remote monitoring tools have enormous potential for patients with chronic illnesses, they remain vastly underused. Case in point: “ninety-one percent of the patients who use wearables identify as an athlete, compared to the only 21 percent who said they have a chronic illness.” Nonetheless, wearable technology is a promising tool in the fight against chronic disease.

Wearables offer a myriad of potential health solutions, from monitoring key health indicators to minimizing touch on shared surfaces. Wearables can open doors in office buildings, for example. Wearables can also monitor and flag changes in body temperature. Over time, wearables can determine trends and track performance, offering increasingly personalized feedback and training opportunities.

Increased adoption of wearable devices and market potential in medicine make wearables a worthy investment.

FitBit has close to 500,000 subscribers to FitBit Premium, with the pandemic strengthening business as consumers seek ways to stay healthier from home. As part of its growth plan, FitBit plans to continue to promote subscriptions that foster engagement, as well as develop telemedicine potential. For example, the company may promote add-on devices such as a connected thermometer or an otoscope that can lessen the need for in-person doctor visits. It’s also conducting research to determine how effective the technology can be in detecting COVID-19 early.

Apple also has its eye on health, specifically monitoring key indicators in senior citizens.

The wearable market isn’t expected to slow down anytime soon. While wearables have shown significant growth thus far, they have loads of potential, especially as it relates to increasing integration with healthcare in a world riddled with chronic disease and reeling from a pandemic.

Unlock a World of Investing with a Magnifi Account

Magnifi is changing the way we shop for investments, with the world’s first semantic search engine for finance that helps users discover, compare and buy investment products such as ETFs, mutual funds and stocks. Open a Magnifi investment account today.

The information and data are as of the November 17, 2020 (publish date) unless otherwise noted and subject to change. This blog is sponsored by Magnifi.

Psychedelic Medicine

While the term “psychedelic” might conjure up thoughts of tie-dye, flares, and rock music, psychedelics have come a long way— specifically, from recreational use at raging concerts to carefully monitored research and medical settings where their potential for mental health healing is studied closely.

In exciting news for the mental health world in particular, psychedelics are just beginning to make a splash in the prescription drug space.

Case in point: In March 2019, Spravato, a drug produced by the Janssen Pharmaceutical Companies of Johnson & Johnson consisting of esketamine (which is derived from ketamine) was approved by the U.S. Food and Drug Administration (FDA) for treatment-resistant depression. This has been regarded as “the first major advance in the treatment of depression since the late 1980s.”

For the millions suffering from depression, that’s a big deal.

As you might have guessed, this new psychedelic drug is not alone on its path to market.

In August 2017, the FDA granted “breakthrough therapy” status to study MDMA (also known as “ecstasy”) for the treatment of post-traumatic stress disorder. The “breakthrough therapy” designation means that the FDA “will expedite the review of the drug and potential approval.”

MDMA-assisted psychotherapy is currently in Phase 3 trials— the final phase before FDA approval.

Then, in October 2018, COMPASS Pathways, a London-based biotech company, received FDA breakthrough therapy designation for its study of psilocybin (aka “magic mushroom”) therapy in treatment-resistant depression. According to one analyst, U.S. sales of this compound alone could reach $108 million in 2025 (the expected commercial launch year of the drug) and $3.3 billion by 2031.

These treatments have enormous potential for medical use, so it’s no surprise that there are many psychedelic startups working on innovative treatments for mental health disorders. In September 2020, COMPASS Pathways became the first psychedelic medicine company to go public on a major US exchange. But, it won’t be the last.

Here’s why you should consider adding psychedelics to your portfolio.

What Is Psychedelic Medicine?

Psychedelics “are powerful psychoactive substances that alter perception and mood and affect numerous cognitive processes.” They include but are not limited to Lysergic Acid Diethylamide (LSD), Psilocybin or “Magic” Mushrooms, DMT/ Ayahuasca, Mescaline/ Peyote, MDMA (or ecstasy), 25I-NBOMe, better known as N-Bomb, Salvinorin A (or salvia), Phencyclidine (or PCP), Ketamine, and Dextromethorphan (or DXM).

Psychedelics cause hallucinations and other sensory disturbances. In short, they work by “stimulating, suppressing, or modulating the activity of the various neurotransmitters in the brain.” While they stay in the body for a relatively short period of time, they can have long-lasting psychological effects.

Psychedelics came into popular use in the 1960s and 1970s but were eventually made illegal, limiting researchers’ access to study them for medical use. LSD was outlawed in the U.S. in 1966, and MDMA was banned in 1985.

It wasn’t until the 2000s that the FDA and the DEA began to approve psychedelic research again. Since then, psychedelics have made their way one by one to labs where they are proving their ability to treat mental health issues including depression, suicidal thoughts, PTSD and anxiety.

The advancement of psychedelics have everything to do with advances in science. According to Amanda Feilding, founder of the Beckley Foundation, which investigates psychoactive substances and advocates for global drug policy changes, “The combination of advancing neuroscientific knowledge, modern brain-imaging technology and psychedelics provides a unique microscope to the mind, allowing us to map changes in consciousness to changes in neuronal and physiological activity. This opens up a new universe in which we can explore novel pathways to treat many of our most intractable illnesses, and to expand our understanding of consciousness itself.”

The more that scientists understand the brain, the greater the potential for psychedelics.

More and more, the clinical community, regulators and investors alike are open to psychedelic treatments. This is especially true following legalization of medical cannabis, which formally recognized the drug’s therapeutic benefit. Cannabis is now only “fully illegal” in seven states.

Despite their progress, however, psychedelics drugs are still considered Schedule I drugs, which are defined by the DEA as “drugs with no currently accepted medical use and a high potential for abuse.” A schedule change remains a hurdle for all research firms hoping to bring psychedelics to the mainstream.

That said, prescription psychedelic drugs are likely to take a more expedited path to FDA approval for prescription use than more traditional counterparts, in part because humans have been consuming them for decades.

Why Invest in Psychedelics?

The growing momentum for psychedelics is happening in parallel to an escalating mental health crisis worldwide.

More than 250 million people worldwide are suffering from depression. And those numbers are only expected to get worse.

In late June 2020, after the arrival of the coronavirus disease 2019 (COVID-19) and resulting global pandemic, 40% of US adults reported struggling with mental health or substance abuse, according to the Center for Disease Control. In another recent study that assessed 402 adult COVID-19 survivors, 55% presented a clinical score for at least one mental disorder, including anxiety (42%), insomnia (40%), depression (31%), PTSD (28%), and OCD (20%).

Depression is a serious condition that “can dramatically affect a person’s ability to function and live a rewarding life,” according to the World Health Organization. “It is characterized by persistent sadness and a lack of interest or pleasure in previously rewarding or enjoyable activities. It can also disturb sleep and appetite; tiredness and poor concentration are common. Depression is a leading cause of disability around the world and contributes greatly to the global burden of disease.”

Depression is linked to suicide, which is the cause of death for nearly 800,000 people every year. It’s the second leading cause of death in 15-29-year-olds.

While depression and mental health issues are growing, they are hard to treat effectively. Psychedelics are offering the world new hope.

The excitement for the psychedelics market reflects that enthusiasm. According to a September 2020 report by US News, the estimated market size for psychedelics could be as large as $100 billion. In other words, as startups begin to successfully bring new psychedelic prescription therapies to market, there will be plenty of potential customers hoping for mental health help lined up at the door.

How to Invest in Psychedelic Medicine

As a broad and emerging industry, psychedelics are currently difficult for investors to access. There are only a few public companies in the space, such as COMPASS Pathways, but there are a number of associated firms that are set to benefit from the growth of psychedelic medicine. A search on Magnifi suggests that there are ETFs and mutual funds available to interested investors.

Unlock a World of Investing with a Magnifi Account

Magnifi is changing the way we shop for investments, with the world’s first semantic search engine for finance that helps users discover, compare and buy investment products such as ETFs, mutual funds and stocks. Open a Magnifi investment account today.

The information and data are as of the October 29 , 2020 ( publish date ) unless otherwise noted and subject to change. This blog is sponsored by Magnifi. This material is provided for informational purposes only and should not be construed as individualized investment advice or an offer or solicitation to buy or sell securities tailored to your needs. This information covers investment and market activity, industry or sector trends, or other broad-based economic or market conditions and should not be construed as investment research or advice. Investors are urged to consult with their financial advisors before buying or selling any securities. Although certain information has been obtained from sources believed to be reliable, we do not guarantee its accuracy, completeness or fairness. Past performance is no guarantee of future results. This content may not be reproduced or distributed to any person in whole or in part without the prior written consent of Magnifi. As a technology company, Magnifi provides access to tools and will be compensated for providing such access. Magnifi does not provide broker-dealer or custodial services.

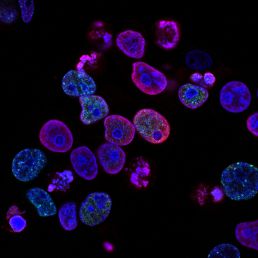

Immunotherapy

Immunotherapy isn’t entirely new, but it’s quickly becoming a major player in the world of cancer care and treatment.

For instance, the global market for immunotherapy drugs is estimated to register a 8.9% CAGR from 2018 to 2023, and Grand View Research is predicting that it will reach nearly $127 billion annually by 2026.

While that might sound enormous, it’s just numbers compared to the impact it has in a doctor’s office when immunotherapy treatment gives a newly diagnosed cancer patient hope.

From fighting cancer to developing a COVID-19 vaccine, immunotherapy is changing the face of medicine. They are also presenting a frontier of innovative solutions that are driving growth in pharmaceutical and biotech industries.

What Is Immunotherapy?

Our immune systems are smart. A “collection of organs, special cells, and substances” that keep tabs on what’s supposed to be happening in our bodies, and what’s not.

So, for example, if it notices a germ that contains unusual proteins that is out of place, it attacks.

But what happens when normal cells start to change in a subtle way, but nothing is really out of place… until the healthy cells start to become more unusual and grow in an uncontrolled way? This is cancer, defined as “a group of diseases characterized by the uncontrolled growth and spread of abnormal cells.” And, because it starts in healthy cells, it can be so tricky for the immune system to stop it before it’s too late.

Immunotherapy is changing that.

According to the American Cancer Society, “immunotherapy is treatment that uses certain parts of a person’s immune system to fight diseases.”

It does so in one of two ways: Either by “stimulating, or boosting, the natural defenses of your immune system so it works harder or smarter to find and attack cancer cells,” or by “making substances in a lab that are just like immune system components and using them to help restore or improve how your immune system works to find and attack cancer cells.”

In other words, it helps a patient’s immune system recognize cancer and attack.

Why Invest in immunotherapy?

In 2020, there will be an estimated 1.8 million new cancer cases diagnosed, according to the American Cancer Society. Immunotherapy is changing the course of treatment for many of those diagnoses, which treatments were traditionally limited to surgery, chemotherapy, and radiation.

New immunotherapy drugs are most commonly being used to fight cancers of the lung, breast, and prostate.

And, even more exciting, they are getting in the cancer game sooner than ever. Coined immuno-oncology (IO) drugs, this subset of immunotherapy drugs give a patient’s immune system the ability to fight cancer cells at an early stage. This can make other more traditional treatments, like surgery, more effective, or potentially unnecessary all together.

Immunotherapies are becoming increasingly more complex. For example, immunotherapies are increasingly being combined in creative ways to treat GI cancers. Even more, simple blood tests have shown to identify which patients may have the most success with immunotherapies.

But, immunotherapy isn’t limited to cancer alone. It’s also being used to fight allergies.

A preventative treatment, immunotherapy for allergies can train the body to slowly become less allergic to a specific substance. Typically, an allergen is given via an allergy shot in incrementally larger doses which causes the immune system to “become less sensitive” to the allergen. Over time, small incremental doses train and change the immune system, building up a tolerance for allergens. Treatments typically happen over the course of three to five years, according to the Mayo Clinic.

It could even give us answers for COVID-19.

The Infectious Disease Research Institute has reported positive results after a clinical trial focuses on the treatment of moderate to severe COVID-19 cases. And, because “cancer behaves like a virus,” the same immunotherapy tools being used to fight cancer are also being employed in the development of COVID-19 vaccines.

If personalized medicine is the care model of the future, immunotherapy, or using a patient’s immune system to battle disease, is as personal as it gets. It’s already delivering cures, and in the race for a COVID-19 vaccine, immunotherapy tools are giving a pandemic-stricken world hope.

How to Invest in Immunotherapy

Key players in the development of new immunotherapies include companies such as: Amgen, AstraZeneca, La Roche, Bayer AG, Bristol-Myers Squibb and many more from the pharmaceuticals space. But given the wide-ranging interest in immunotherapy drug development, it can be difficult for investors to access the whole world of these treatments by investing in individual companies.

However, a search on Magnifi suggests that there are a number of ETFs and mutual funds dedicated to immunotherapy.

Unlock a World of Investing with a Magnifi Account

Magnifi is changing the way we shop for investments, with the world’s first semantic search engine for finance that helps users discover, compare and buy investment products such as ETFs, mutual funds and stocks. Open a Magnifi investment account today.

The information and data are as of the August 12, 2020 (publish date) unless otherwise noted and subject to change. This blog is sponsored by Magnifi.

Biotech

If you are the sort of person who enjoys a cold beer after a long day, it may surprise you to learn that the beverage in your hand is a product of biotechnology.

Really.

That’s because, in the case of beer, brewers harness the biological power of yeast to produce alcohol through fermentation. Brewing is among the oldest known examples of humans harnessing natural biological processes to create something new, and modern biotech is simply a more advanced version of this ancient practice.

Modern biotech really took off in the 1970s following scientific breakthroughs in the field of genetic engineering. By combining DNA from two different organisms and inserting the new hybrid DNA into a host cell, scientists harnessed the natural process of DNA replication to produce large quantities of hybrid molecules. This technology, known as recombinant DNA technology, revolutionized biology and ushered in a new era of possibilities in which complex new substances could be synthesized in quantities sufficient to benefit mankind.

For example, Genentech, an early pioneer in biotech, used recombinant DNA technology to develop a process for creating synthetic human insulin in the early 1980s. Prior to Genentech’s breakthrough, diabetics had to take insulin derived from the pancreas’ of pigs and cattle.

Another major biotech breakthrough happened when Monsanto, an agrochemical company, introduced “Roundup Ready” crops in 1996. Monsanto genetically engineered Roundup Ready crops to be resistant to the highly-effective herbicide Roundup, which Monsanto had been selling since the 1970s. Farmers could buy Roundup Ready seeds from Monsanto and apply Roundup herbicide to their fields and the Roundup would kill all plants except the Roundup Ready crops, making the task of weed control significantly easier.

Big advances in biotech have been met with a combination of excitement and concern over the years, but the transformative potential of new discoveries is undeniable.

For those interested in the investment potential of this innovative industry, there are a few important points to understand.

What is biotech?

At the highest level, biotechnology (or “biotech”) is defined as the use of biology to solve problems and make useful products. This involves the use of biology to solve problems and make useful products. Modern biotech encompasses a wide range of products and technologies.

As an industry, biotech can generally be divided into three sub-industries: biopharmaceuticals, agricultural biotech, and industrial biotech.

The biopharmaceutical (aka biopharma) industry focuses on developing new drugs through genetic engineering, such as with Genentech’s development of synthetic insulin. Biopharma drugs are composed of molecules that are larger and more complex than traditional pharmaceuticals. These complex drugs have enormous potential for disease treatment because they are highly-effective and cause few side effects.

The agricultural biotech industry focuses on developing new agricultural products through genetic engineering, such as with Monsanto’s development of herbicide-resistant crops. Agricultural biotech aims to make agriculture more efficient by improving crop yields, making crops less susceptible to pests and disease, and improving the nutritional value in food.

Lastly, the industrial biotech industry focuses on harnessing the power of biological processes such as fermentation to produce energy and make industrial processes more efficient. For example, ethanol is a biofuel that is produced by fermenting corn, and it is added to gasoline to reduce air pollution. Many scientists are hopeful that further development of biofuel technology will play an important role in combating climate change.

While people tend to associate biotech primarily with the healthcare sector, it is important to note that biotech has a wide variety of innovative applications across numerous industries.

Why invest in biotech

As an industry, biotech offers a rare opportunity in this turbulent market because it outperforms the market in recessions and the evolution of healthcare points to long-term growth.

In the recessions of 2001 and 2008-2009, biotech outperformed the S&P by an average of 18%. Even with the S&P’s recovery in recent months, the index is still down about 5% for the year as of mid-June, while the largest and oldest biotech ETF, iShares Nasdaq Biotechnology ETF (IBB), is up about 12%.

Stepping away from short-term volatility, Polaris Market Research projects that the industry will see a compound annual growth rate of about 7% over the next several years. The need to develop innovative treatments to challenging diseases is seen as the primary force driving this long-term growth.

Hanging over this entire discussion of performance is, of course, the impact of COVID-19. Biotech companies are in a race to develop a vaccine for COVID-19, and some companies, such as Moderna, are seeing massive gains after reporting positive results.

How to invest in biotech

The key point to keep in mind when looking at biotech investing is accurately gauging risk tolerance. Biotech is a volatile place to invest in the best of times, and these are not the best of times. Companies spend years and billions of dollars developing treatments, and the reality is that not every treatment works or is approved.

Investors interested in the massive potential of biotech would do well to do their homework and honestly assess their appetite for wild price swings. Biotech looks to have a bright future, and the industry does have a history of beating the market, but it is important to understand that it comes at the cost of high volatility.

That’s why investing in a biotech-focused ETF or mutual fund is a good way to gain exposure to this growing but volatile sector. A search on Magnifi suggests there are a number of different ways for investors to do this.

Unlock a World of Investing with a Investment Account

Magnifi is changing the way we shop for investments, with the world’s first semantic search engine for finance that helps users discover, compare and buy investment products such as ETFs, mutual funds and stocks. Open a Magnifi investment account today.

The information and data are as of the June 24, 2020 (publish date) unless otherwise noted and subject to change. This blog is sponsored by Magnifi.

Precision Medicine

One universal and challenging reality of healthcare is that we all respond differently to different treatments. We’ve all had those frustrating moments when we learn that the medicine we recently tried that made no real improvement on our ailment somehow worked brilliantly for a friend or family member.

The reason for this variability stems from the fact that everyone has unique genetics, lifestyles, and living environments. Our genetic makeup, lifestyle choices, and the physical environment around us all impact how our bodies respond to sickness and medicine.

For instance, a small percentage of the population has an enzyme deficiency due to genetics. People with this deficiency are not able to process drugs called thiopurines, which are used to treat autoimmune disorders, certain types of cancer, and organ transplants.

The traditional approach to medicine involves doctors giving sick patients treatment that works well for most people, and adjusting course if the treatment does not work. This approach may work well enough when the illness is not serious, but it can be downright dangerous if the patient has an aggressive disease and there is not enough time for trial and error treatment.

In response to the limitations of traditional medicine, there is growing interest in a new approach called precision medicine. Unlike traditional medicine, precision medicine approaches treatment from the perspective that all patients are highly unique, and that in order to provide the most effective treatment, doctors need to understand exactly what makes a patient unique.

Precision medicine is a data-driven approach to healthcare, and recent advances in computer science and technology are harnessing data to drive innovation across the healthcare sector. There are significant challenges that need to be addressed before precision medicine can have a global, transformative impact, but leaders throughout healthcare and government are increasingly recognizing precision medicine’s enormous potential to deliver better care faster.

For those interested in the investment potential of this growing industry, there are a few important points to understand.

What Is Precision Medicine?

According to the National Institutes of Health (NIH), precision medicine is “an emerging approach for disease treatment and prevention that takes into account individual variability in genes, environment, and lifestyle for each person.”

The “precision” in precision medicine allows doctors and researchers to more accurately pinpoint which treatments will be most effective for certain people or groups of people.

Three fields that are rapidly driving innovation in precision medicine are genetic testing, pharmacogenomic testing, and medical imaging.

According to the NIH, genetic testing is “a type of medical test that identifies changes in chromosomes, genes, or proteins. The results of a genetic test can confirm or rule out a suspected genetic condition or help determine a person’s chance of developing or passing on a genetic disorder.” Genetic testing is currently used to identify people who are at particular risk for certain types of cancer (such as with the BRCA gene test for breast cancer), and the hope is that in the future, genetic testing will expand into the realm of primary care as a noninvasive screening test for preventive medicine.

Pharmacogenomic testing is a type of genetic test used to figure out how a patient will

respond to certain medications. Our genetic makeup contributes to how we respond to medicine, so pharmacogenomic tests look for clues in our genes to figure out which medications, or what doses of those medications, are likely to work best.

As mentioned earlier, some people have an enzyme deficiency that makes thiopurines ineffective. A pharmacogenomic test for this enzyme deficiency lets the doctor know whether thiopurines are a good course of treatment before treatment begins, rather than adjusting course after complications arise.

Last but not least, medical imaging encompasses the various technologies that allow us to view the human body in order to diagnose, monitor, or treat medical conditions (MRIs, CT scans, etc.). Innovative technological solutions are changing how images are gathered and interpreted.

By harnessing the power of artificial intelligence and deep learning, Intel recently developed technology that was able to identify thyroid nodules in patients with 10% higher accuracy than the radiologists. Innovations in genetic testing, pharmacogenomic testing, and medical imaging are accelerating the expansion of precision medicine in the healthcare ecosystem.

Why Invest in Precision Medicine?

The investment potential in the precision medicine industry is likely substantial, and there are several clear reasons for this.

First, leaders in government are beginning to recognize the enormous potential of precision medicine and are committing substantial resources to support innovation. For instance, President Obama launched the Precision Medicine Initiative (PMI) in 2015 with $215 million in funding to drive research and expand precision medicine across the U.S. healthcare ecosystem. A cornerstone of the PMI is the groundbreaking All of Us Research Program, which plans to enroll and follow a diverse group of at least 1 million people in the U.S. in order to accelerate medical research and improve health.

Government funding aside, the proliferation of direct-to-consumer genetic testing is another driver of precision medicine’s long-term strength. Companies such as 23andMe and Ancestry.com offer genetic testing that provides customers with genealogy and health insights.

Millions of people have taken these at-home genetic tests, and testing companies now sit on mountains of valuable data. That data, when properly (and legally) harnessed, is enormously valuable in developing new drugs.

While precision medicine is clearly going to continue changing the healthcare landscape in the coming years, there are a few challenges that need to be addressed before it becomes a game changer for everyone.

The first challenge is data. Health data is not like other data – it is subject to extensive and strict government regulations (HIPAA in the U.S., for instance). How will companies navigate these complicated data issues as they work to integrate precision medicine solutions?

The next challenge is access. If you are poor or uninsured, precision medicine, as it currently stands, is likely too expensive for you to use. Will prices come down as innovation accelerates, or will governments need to step in to improve access for everyone?

These are questions that thought leaders in healthcare, private industry, and government are thinking about, and they are worth considering if you are interested in investing in precision medicine.

How to Invest in Precision Medicine

Of course, investing in a field as new and innovative as precision medicine comes with its share of risk. As an emerging segment of healthcare, precision medicine is still growing and the companies in this sector are still working out where that can make the biggest impact. With this in mind, investing in precision medicine via an ETF or mutual fund is a good way to access this emerging field without taking on undue risk. A search on Magnifi suggests that there are a number of ways to do this.

Unlock a World of Investing with a Magnifi Investment Account

Magnifi is changing the way we shop for investments, with the world’s first semantic search engine for finance that helps users discover, compare and buy investment products such as ETFs, mutual funds and stocks. Open a Magnifi investment account today.

The information and data are as of the June 16, 2020 (publish date) unless otherwise noted and subject to change. This blog is sponsored by Magnifi.

Medical Devices

When we think “medical device,” we might automatically think of the beeping equipment in a hospital room. But, in today’s world, medical devices are much more— perhaps even closer to science fiction than traditional science.

The medical device market is anticipated to reach $432.6 billion by 2025, according to a recent report published by Lucintel.

In part, this growth is driven by the increasing sophistication of technology. Medical devices are becoming smaller and smarter than ever, performing increasingly complex and constantly improving functions.

[What else is happening in healthcare? Here’s Magnifi’s take.]

Moreover, escalating healthcare costs, a rise in chronic diseases, and a growing aging population are compelling health care providers to seek out new, more efficient care models. From 3D printing human tissues to monitoring patients according to their specific clinical needs after they leave the hospital, innovative medical devices are meeting that need.

New medical devices are offering a myriad of useful answers to complex health challenges, changing the reality of care in new and exciting ways.

What Are Medical Devices?

According to the World Health Organization, ‘medical device’ means any instrument, apparatus, implement, machine, appliance, implant, reagent for in vitro use, software, material or other similar or related article, intended by the manufacturer to be used, alone or in combination, for human beings, for one or more of the specific medical purpose(s) of:

- diagnosis, prevention, monitoring, treatment or alleviation of disease,

- diagnosis, monitoring, treatment, alleviation of or compensation for an injury,

- investigation, replacement, modification, or support of the anatomy or of a physiological process,

- supporting or sustaining life,

- control of conception,

- disinfection of medical devices

- providing information by means of in vitro examination of specimens derived from the human body;

and does not achieve its primary intended action by pharmacological, immunological or metabolic means, in or on the human body, but which may be assisted in its intended function by such means.

So, health monitors, check. Brain sensors, check. 3D printed prosthetics (and ears!), check again.

Why Invest in Medical Devices?

The landscape of medical devices is growing rapidly, with technology making the impossible possible.

Wearables

The rise in wearables isn’t limited to FitBits. And when it comes to medical devices, wearables do much more than measure your steps. For one, wearables can offer real-time patient data to health care providers. And, when they connect with Artificial Intelligence-based programs, they not only collect information, but also analyze it against big data.

Up-to-minute information about vitals limits the need for in-person appointments and can lead to better patient outcomes. For example, Current Health’s Remote Patient Monitoring Platform is AI powered and customizable according to a patient’s risk level.

Some emerging wearables can also perform health interventions. In early 2019, the U.S. Food and Drug Administration (FDA),approved the first wearable, portable peritoneal dialysis. Developed by Singapore-based AWAK Technologies, the device has the potential to change the lives of dialysis patients around the world.

Perhaps even more exciting, researchers at the University of Michigan have developed a wrist-worn prototype that screens the wearer’s blood over the course of a few hours, analyzing it for circulating tumor cells (CTCs).

Wearables can be used for everything from pre-surgical planning to gene sequencing and medical imaging, making their health and investment opportunities plentiful.

Brain Sensors

These days, brain sensors come in many shapes and sizes. Some are placed in the brain itself, measuring temperature and pressure before dissolving. This information can be crucial for patients with traumatic brain injuries, for example. Their dissolvable nature not only negates the need for surgery to remove them, but also limits the risk of infection and complications associated with long-term implants.

Alternatively, the company Advanced Brain Monitoring offers products designed to track function as it relates to chronic diseases and early stage neurodegeneration.

Still others are more consumer oriented, like the company Muse, which sells headsets that act as a brain fitness tool, measuring and tracking brain activity.

Artificial Organs

Certainly many things — like the heart — can’t be replicated. Right? Actually, that’s not entirely true anymore.

iSynCardia Systems recently received FDA approval for its most recent iteration of a total artificial heart, the 50cc temporary Total Artificial Heart System (50cc TAH-t).The company’s artificial heart, first approved in 2004, is meant to be a bridge until a biological donor becomes available. Artificial organs, whether printed or made otherwise, offer a lot of promise, providing millions waiting on donor organs an alternative.

3D Printing

According to the FDA, “3D printing is a process that creates a three-dimensional object by building successive layers of raw material.”

Not only does 3D printing allow for the creation of more patient-specific devices, it allows for more specific variation in medical tools. Rather than buying large quantities of a tool, providers can print them on demand. Similarly, customized prosthetics and orthopedic implants are more possible than ever, improving the likelihood of patient success.

Bioprinting

Now, for the real science fiction stuff.

Bioprinting uses carefully designed bio inks made of biomaterials and cells to 3D print living obstacles, such as tissue or organ. Pioneered a decade ago, bioprinting in its early days was developed to improve wound reconstruction related to burns, one of the most common types of traumas worldwide. Since then, scientists have gone as far as to develop a prototype of a handheld bioprinter designed specifically to help skin regenerate in areas affected by large wounds.

Beyond skin, scientists have succeeded in bioprinting an artificial pancreas, a synthetic ear, a meniscus made in space, and even bone tissue. Researchers are even working on bio-printed ovaries for women suffering from infertility.

How to Invest in Medical Devices

As an emerging industry, particularly one in the feast or famine sector of biotech, investing in medical devices directly can be risky. Although medical devices on the whole have been around for decades, the innovative new solutions at the forefront of the industry remain largely untested. This can make investing in individual medical device companies a risky proposition.

However, a search on Magnifi indicates that there are a number of ETFs and mutual funds available to give investors broad exposure to this industry without concentrating their bets on any one company.

Unlock a World of Investing with a Magnifi Account

Magnifi is changing the way we shop for investments, with the world’s first semantic search engine for finance that helps users discover, compare and buy investment products such as ETFs, mutual funds and stocks. Open a Magnifi investment account today.

The information and data are as of the June 11, 2020 (publish date) unless otherwise noted and subject to change. This blog is sponsored by Magnifi.

Healthcare

Make no mistake, the COVID-19 pandemic has been a wake-up call for millions of people around the world. Suddenly, maintaining our health is the most important thing on our minds, overtaking all of the usual daily tasks like work, school and entertainment.

Economies have shut down, governments have scrambled to adapt and we’re still not yet sure what the world will look like on the other side of this.

But one area that’s seeing direct impacts is the healthcare industry. Not only are millions turning to their healthcare providers for help addressing COVID-19, but they’re also doing so in new ways as a result of the pandemic. Stay-at-home orders and concerns over exposure at hospitals have led to an explosion in the use of telehealth and digital health services.

This isn’t all new, of course. It’s been a long time since the stereotype of the lone country doctor doing house calls has been even close to true, and the industry has been evolving and growing ever since its earliest stages prior to the Civil War. In those days, medical care was a luxury with hospitals located in a few major cities to serve patients but little else available. The first hospital in the U.S., the Royal Hospital in New Orleans, opened in 1722 as a military facility but was later switched over for civilian use. By that point it was too expensive for the majority of the residents in the area to visit, so a second, charity-based hospital was built nearby, starting the tradition of hospitals serving all as a type of public service.

Medical innovation accelerated dramatically in the 20th century, with the advent of new technologies like X-ray and Magnetic Resonance Imaging improving doctor’s diagnostic capabilities, the expansion of vaccines helping to protect public health from infectious diseases, to new surgical anesthetics, antibiotics, heart surgeries, radiologic imaging and more.

As ABC News explained in 2007: “Whether it’s the technology that allows us to peer deep into the body or medicines that extend the lives of those with chronic diseases, it’s easy to see how advances in health and medicine have touched the lives of nearly every person on the planet. Yet considering the ubiquitous nature of these developments, it is easy to see how many people take for granted the technologies and practices that, at one point or another, almost certainly saved their own lives or the lives of people they’ve loved.”

The history of healthcare is a history of innovation.

That’s one of the reasons that it has become such a popular segment for investors looking to generate gains while also supporting work that’s protecting the health of millions of people. But, for those interested in the investment potential of this booming market, there are a few important points to understand.

What Is Included in ‘Healthcare’?

According to Webster’s dictionary, “healthcare” includes any “efforts made to maintain or restore physical, mental, or emotional well-being especially by trained and licensed professionals.” This includes everything related to maintaining or improving a person’s health, including the prevention, diagnosis, treatment, recovery or cure of diseases, injuries and any other physical problems that they might be experiencing.

And the list of other professionals involved in delivering healthcare is equally long, including doctors, nurses, surgeons, pharmacists, dentists, optometrists, psychologists, therapists, athletic trainers and more. Anyone providing care to people – including on the scale of public health – is involved in healthcare.

Here in the U.S., the term “healthcare” also typically applies to the entire healthcare delivery system, ranging from individual doctor’s offices all the way up to hospitals and pharmaceutical companies. A health system is a network of related facilities – usually three to 10 hospitals – that work together to deliver health services to patients in their geographic area. The National Bureau of Economic Research defines health systems based on three types of arrangements: (1) organizations with common ownership, (2) those that are contractually integrated, and (3) those that are part of informal care systems, such as common referral arrangements. “Systems include organizations combined horizontally (e.g., a hospital system) or vertically (e.g., a multihospital system also owning physician practices and post-acute care facilities).”

These systems are typically major employers in their communities and are effectively one-stop-shops for all of their patient’s healthcare needs.

Of course, delivery is just part of the healthcare equation. It also has to be paid for, and that’s where the health insurance side of things comes into the picture. Health insurance today is a tangled web of private plans, employer-provided plans, government-backed programs like Medicare and Medicaid and more. Add to this the Affordable Care Act, introduced in 2010, intended to overcome some of the limitations of the private, for-profit health insurance industry and expand affordable coverage to all Americans.

Why Invest in Healthcare?

As an industry, healthcare is massive.

Worldwide, the industry was worth $8.45 trillion as of 2018 and accounts for about 10% of most GDPs. This is on track to exceed $10 trillion by 2022.

In the U.S., it’s even bigger. As of 2019, healthcare accounted for nearly 18% of U.S. GDP and is the country’s largest employment sector, employing 1 out of every 8 Americans. We also spend the most on our health individually, at more than $10,000 annually per capita.

It’s also an extremely lucrative segment of the economy. Among the 784,000-plus companies in U.S. healthcare, more than $1 trillion in annual revenue comes from patient services, with $74 billion coming from rehab services, $50 billion from dental services and more than $44 billion from government grants and contributions. Healthcare deals with a lot of big numbers.

But there are hopes that new technologies can help tame this system and unlock new efficiencies. According to some estimates, the internet of things (IoT) can lower the costs of operational and clinical inefficiencies by $100 billion per year, and 64% of physicians believe it can help reduce the burden on nurses and doctors.

Beyond IoT, healthcare is finding new applications for Artificial Intelligence in managing patient care, blockchain in handling patient health records, chatbots for customer service and virtual reality for physician training. That’s to say nothing of the potential for marketing automation, supply chain logistics and other proven technologies that are finally finding applications in the healthcare space.

How to Invest in Healthcare

Naturally, healthcare is a large and sprawling industry. For investors, it can be challenging to choose where to invest in a segment that includes everything from drug development, to medical devices, to home health services and much more.

Investing in a mutual fund or ETF that offers exposure to the entire healthcare world is a good way to overcome this limitation, and a search on Magnifi suggests that there are a number of such funds for investors to choose from.

Unlock a World of Investing with a Magnifi Account

Magnifi is changing the way we shop for investments, with the world’s first semantic search engine for finance that helps users discover, compare and buy investment products such as ETFs, mutual funds and stocks. Open a Magnifi investment account today.

The information and data are as of the June 3, 2020 (publish date) unless otherwise noted and subject to change. This blog is sponsored by Magnifi.